Disclaimer: This article is for entertainment purposes only and cannot be used for financial advice. Since its inception, Bitcoin has caught the

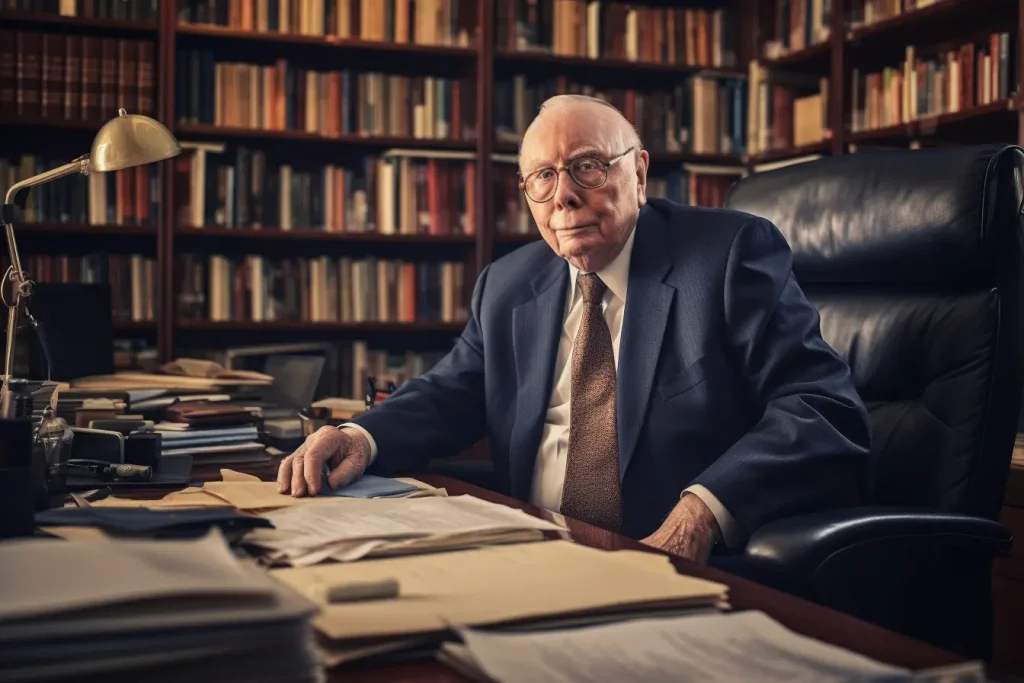

In late November 2023, the life of iconic investor Charlie Munger sadly came to an end. Described by many as Warren Buffett’s confidant, however, he is much more than that. In this article, we look back on the successful life of this investor.

Charlie Munger was born in Omaha, Nebraska, in 1924. He grew up during the Great Depression (1930s in the 20th century), which had a lasting impact on his outlook on both life and investing.

In Omaha, the American also attended public school, where he soon managed to excel. He then went to the University of Michigan to study mathematics. This study he decided to interrupt to join the army during World War II. After his military service, he was admitted to Harvard Law School. During this study, he gained important knowledge, particularly in tax law, business law and contract law.

Not soon after, he divorced his wife, to whom he lost all his money. Then his son died at the age of 8. Despite these setbacks, Mr Munger was determined to become successful. Soon fortune found him and he married his new wife. Because of the death of his father, he returned to Nebraska to take care for his family. Here he met his future business partner Warren Buffett.

Next he moved to California to open his own law firm. He also opened his own investment firm called “Wheeler, Munger & Co” with his then business partner Jack Wheeler in 1962. From 1962 to 1975, his firm achieved an average return of 19.8%, while the Dow-Jones averaged “only” 5% per year in returns during this period. Nevertheless, the company made a loss during the oil crisis (1973), so Charlie Munger felt compelled to close the company. During this period, he also quit his law firm on the advice of Warren Buffett. Over the next few years, he began investing with, indeed, Warren Buffett before becoming vice chairman of Berkshire Hathaway in 1978. The golden duo was a reality.

Investment philosophy

Charlie Munger had a lot of influence on Warren Buffett’s investment strategy. For example, Warren Buffett used the so-called “cigar butt” method. This involved an investor buying an undervalued stock of a bad company. This with the idea of making a short-term profit.

As a result, there came a change in Berkshire’s view regarding value investing: It stated: “Forget what you know about buying companies at nice prices, instead buy nice companies at fair prices.”

Charlie Munger’s “mental models” also play an important role in his vision. He believed you needed a broad general knowledge to become successful as an investor. An investor needs knowledge in various subjects such as, indeed, law, but also in psychology, economics and mathematics.

Charlie Munger was known as a man of great patience; this was reflected in his passive investment philosophy. He believed that making a profit was not a matter of buying or selling stocks, but rather patience and simply waiting. If you owned a stock long enough, its value would naturally move toward its intrinsic value.

In addition, he was not an advocate of diversification. According to Munger, your returns are limited when you own many different stocks. Instead, he appointed that it is better to have a concentrated portfolio consisting of a limited number of stocks. When Charlie Munger died, he personally owned only 3 different stocks.

Consequently, this mindset caused him to be selective. He believed that opportunities are always scarce and looks critically at new technologies. For example, he is absolutely not a fan of Bitcoin and even calls it the worst investment ever.

This cautious view of new technologies is also a result of the fact that he thus grew up during the Great Depression. During his childhood, partly because of the Great Depression, there was a lot of poverty around him. As a result, he always remained cautious when it came to new technologies.

Furthermore, Munger valued ethics within companies. Companies that do not act ethically will eventually make decisions that are bad for the company. Therefore, investors should stay away from companies that perform poorly in terms of ethics, even if they have potential financially. Charlie Munger himself was known as a reliable business partner, which no doubt was partly responsible for his successes.

His view of ethics can also be seen in his philanthropic activities. For example, he donated at $300 million to make rooms more affordable for American students.

Life Lessons

Charlie Munger was known for his beautiful quotes and particular outlook on life. First, he emphasized the importance of lifelong learning. He mentioned that all the wise people around him read many books to keep gaining knowledge. Also, according to Munger, it is to look critically at your surroundings and surround yourself only with people who are trustworthy.

Furthermore, Charlie Munger was a great advocate of personal growth, in this, he said, there was no room for self-pity, but rather discipline. Discipline, according to him, was necessary to become successful.

Munger also believed that a person should be humble. Despite his status as a multibillionaire, he lived a relatively bleak existence and spent little money. This too was a result of growing up during the Great Depression. According to him, jealousy brings out the worst in man and should be avoided at all costs, for example by living frugally.

All in all, we can conclude that Charlie Munger has been of great value to Berskhire Hathaway and the entire investment world. His wisdom will always be used.