In this article, both Stijn and Sebastiaan discuss their roles as a board member of Asset | Accounting & Finance. First, Stijn will talk more

Disclaimer: This article is for entertainment purposes only and cannot be used for financial advice.

Since its inception, Bitcoin has caught the world’s attention as a revolutionary form of digital money. It is a decentralised and distributed network that enables transactions without the intervention of central authorities such as banks or governments. One of Bitcoin’s most unique features is its ‘halving’. This halving took place on 20 April this year. This article discusses the Bitcoin halving in detail, including what it is, why it takes place, and what impact it has on the Bitcoin ecosystem.

The Bitcoin halving, also known as the ‘halving’, is an event that takes place every four years, or after every 210,000 blocks added to the blockchain. It is a built-in mechanism in the Bitcoin protocol that halves the rate at which new Bitcoin is produced. In other words, the reward for mining new Bitcoins is halved.

How does Bitcoin mining work?

To fully understand Bitcoin halving, we first need to understand how Bitcoins are created. New Bitcoins are created through a process known as ‘mining’ or ‘mining’. This is the process by which computers solve complex mathematical puzzles to verify transactions and add new blocks to the blockchain. Miners who successfully add a block are rewarded with Bitcoins.

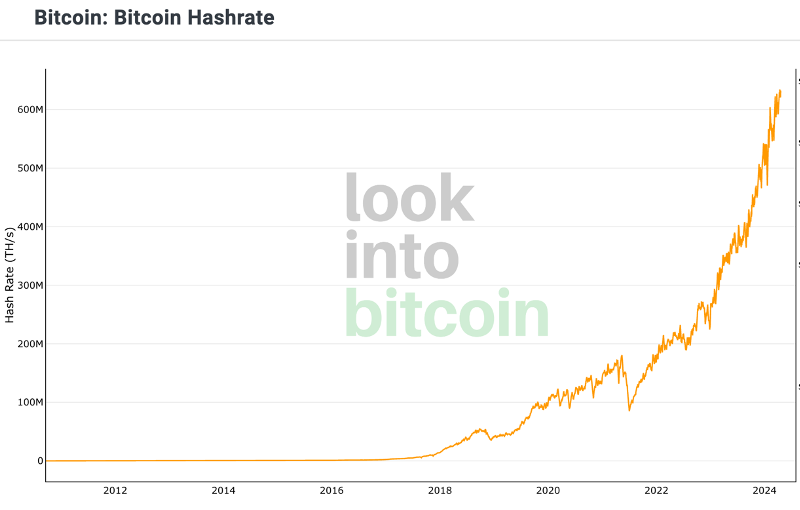

At the beginning, these mathematical puzzles were easy to solve, but as more and more miners try to solve these puzzles, the difficulty of these puzzles has also grown exponentially. The growth of how much computer power it takes to mine a Bitcoin, which is also known as the hashrate is shown in the image below:

While at the birth of Bitcoin people could still mine Bitcoins on their laptops, today this is done in large warehouses where there are thousands of gpu to solve these mathematical problems. These gpu need a lot of electricity. This is also where the criticism comes from that Bitcoin cannot be seen as sustainable.

Impact of halving on supply

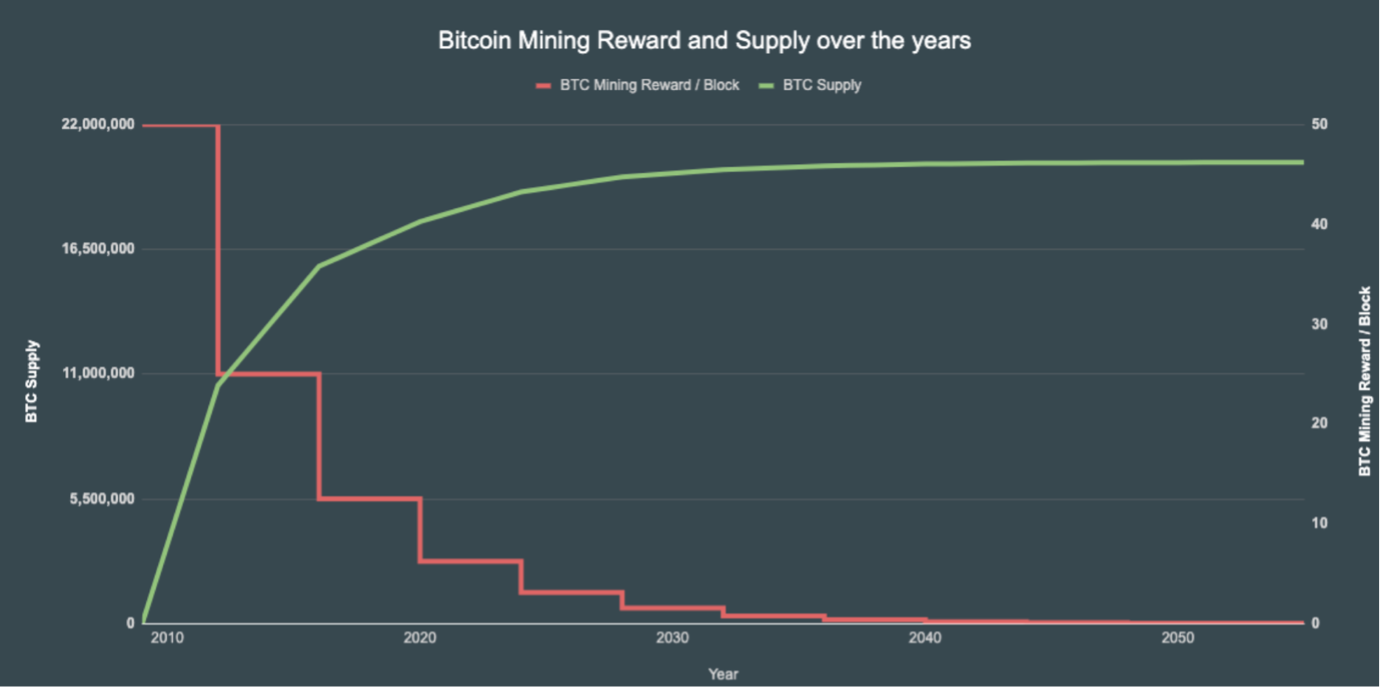

The halving is a crucial aspect of the Bitcoin protocol because it reduces the inflation of Bitcoins and slows down the supply of new Bitcoins. This mechanism is designed to reach the total supply of 21 million Bitcoins, making it a scarce commodity.

When Bitcoin was launched in 2009, the reward for mining a new block was 50 Bitcoins. Then the first halving took place, halving the reward to 25 Bitcoins. The second halving took place in 2016, again halving the reward to 12.5 Bitcoins. The third halving took place in May 2020, again halving the reward to 6.25 Bitcoins. In the halving that just took place, Bitcoin was halved again to 3.125 Bitcoins. This means that Bitcoin’s annual inflation rate has fallen from 1.7 to 0.85%. As a result, Bitcoin’s inflation rate is now also lower than gold.

The Bitcoin halving has a number of important implications for both miners and investors. For miners, the halving may lead to reduced profitability as they receive less reward for their efforts. This could lead to a loss of mining business, especially for miners with high operating costs.

On the other hand, the halving may increase the demand for Bitcoins, as the supply of new Bitcoins decreases. This may lead to an increase in the price of Bitcoin on the market, as historical data has shown. Investors often see the halving as a ”bullish” signal for Bitcoin’s price, and some even speculate on a ”halving rally”, with Bitcoin’s price rising sharply after the event.

The Future of Bitcoin Halving

Although Bitcoin halving is a built-in mechanism that has been taking place since Bitcoin’s inception, it remains a subject of debate and speculation within the community. Some believe that halving will continue to play a crucial role in Bitcoin’s monetary policy and protect its value. Others believe that future developments, such as scalability solutions and changes in the consensus mechanism, could change the role of the halving over time.

Currently, about 19.7 million of the 21 million Bitcoins have been mined, representing almost 94% of the total supply. The last Bitcoin is expected to be mined in 2140. However, the fact that all Bitcoins will be mined does not mean that miners will stop maintaining the network. In fact, they also receive a small fee for every transaction they process.

Impact of Bitcoin halving on price

Bitcoin halving, which occurs about every four years, has historically had a significant effect on the price of Bitcoin. This event reduces by half the reward miners receive for verifying transactions and adding new blocks to the blockchain. This reduces the supply of new Bitcoins on the market, which can lead to a decrease in selling pressure from miners.

In the past, halves have often led to increases in the price of Bitcoin. This is partly due to reduced supply growth, which reduces Bitcoin inflation. In addition, the prospect of scarcity can encourage investors to buy Bitcoin, which can boost demand and thus the price. After the previous halves, the price of Bitcoin rose by the following:

After the 2012 halving, the price went from $12 to above $1000, an increase of almost 10000%. After the 2016 halving, the price has gone from $600 to above $19000 an increase of more than 3000%. In the past halving in 2020, the price rose from about $10000 to above $60000 an increase of about 600%. It can be seen that Bitcoin’s percentage rise keeps falling after each halving. This increase is shown in the image below:

However, it is important to note that the price reaction to halves is not immediate and there are also other factors influencing the price of Bitcoin, such as market sentiment, institutional commitment, regulation and macroeconomic developments.

Conclusion

Bitcoin halving is an essential part of the Bitcoin ecosystem, designed to reduce inflation and protect the value of Bitcoins. By halving the rewards for miners, the halving creates a scarcity that can increase demand for Bitcoins and raise their price. While the impact of the halving is difficult to predict in the short term, it remains an important event that the entire Bitcoin community is looking forward to.