In a matter of weeks, artificial intelligence took over the world in a way unseen before. With the launch of ChatGPT by OpenAI in November 2022,

For the Dutch version, click here.

They are two companies you don’t often think about, but they are essential to your daily life. Every time you take your bank card out of your pocket, you will see the logo of one of these two companies on it. But what exactly do these companies do and how did they come to be? That will be explained in this article.

Visa & Mastercard created the payment network that the whole world runs on. Together, they have an annual payment volume that exceeds $20 trillion, and each year they process more than 300 billion transactions. Both figures are increasing by 10 per cent every year. So, to understand this better, these companies process about 10,000 transactions per second.

Origins of Visa & Mastercard

Visa

18 September 1958 is an important date in Visa history. This was in fact the date when Bank of America launched their BankAmericard credit card in Fresno, California.

The BankAmericard was the invention of Joseph P. Williams, the leader of Bank of America’s internal development think tank, the Customer Services Research Group. Williams’ greatest success was the implementation of the first universal credit card.

In the 1950s, the typical middle-class American had multiple revolving credit accounts with different merchants. This system was clearly inefficient and cumbersome for both merchant and consumer. The need to carry so many accounts or cards for both parties and keep track of individual accounts each month led to the need for consolidation. At the time, there was no uniform financial instrument available to the public. This was obvious to the financial industry, but no one managed to solve this problem.

At that time, the Diner’s Club card already existed, a card that allowed payment on credit at restaurants and hotels across the country. This card was mainly used by businessmen. Its drawback was that bills had to be paid in full every month. This company also failed to reconcile the many credits.

After studying the failures, Williams and Bank of America decided to conduct a test. They chose Fresno, California, as the test location for their idea; with a population of 250,000, it was large enough to make a credit card work, but small enough to keep start-up costs under control. At the time, Bank of America had a 45% market share in Fresno. The test went well, and in March 1959 it expanded to San Francisco and Sacramento, and by June it was already expanding to Los Angeles.

By the end of October that year, more than 2 million people had the BankAmericard, and it was accepted by more than 20,000 merchants across the state.

In the years that followed, BankAmericard continued to expand. In 1974, the company went international, and in 1975 the company launched the widely used debit card. 1976 was the year the company was rebranded as what is now known as Visa.

Mastercard

Mastercard was created in 1966 in response to the growing need for an alternative credit card option to BankAmericard (now Visa). Four Californian banks joined forces and introduced “Master Charge: The Interbank Card.” This system allowed consumers to make purchases from different merchants and pay the bill later. In 1969, the name was changed to MasterCard, and the distinctive red and yellow circular logo was introduced.

The early MasterCard system focused mainly on facilitating payments between banks and merchants. Customers could make transactions at participating merchants, and payments were later processed by the cardholder’s issuing bank.

Early bank authorisations for credit card transactions were initially handled by telephone. But in 1973, Interbank revolutionised the authorisation process and set up a centralised computer network that connected merchants with credit card issuing banks.

How do the companies work

Together, Mastercard and Visa are part of a duopoly that connects consumers and businesses worldwide, allowing money to move easily. Visa & Mastercard provide the infrastructure that allows banks (financial institutions) and businesses to communicate with each other.

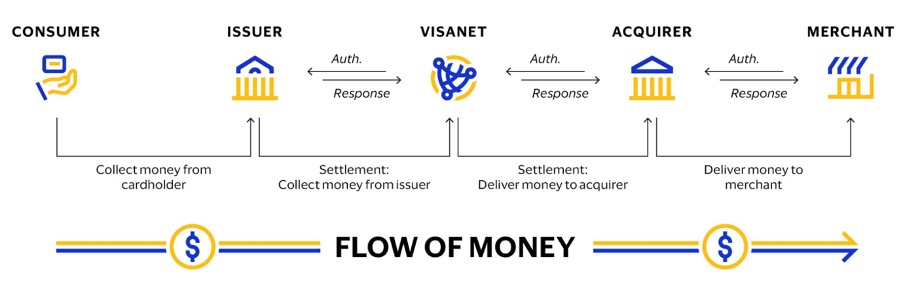

So, how do these companies make money? Let’s look at the image below to better explain the model. This image is taken from Visa’s annual report, but the process for Mastercard is almost identical.

(Flow of money Visa 10-K 2023)

Consumers are the consumers who hold a Visa debit or credit card.

Issuers, such as JP Morgan and ING are the financial institutions that offer Visa cards to account holders. The banks also set interest rates on credit cards and determine any fees they may charge their account holders.

Visanet or Mastercard facilitate electronic payment transactions between financial institutions. It acts as a payment network that processes and authorises transaction data, transferring money from the cardholder to the merchant.

Acquirers are the banks or processors that have companies such as Albert Heijn as customers.

Merchants are companies that accept Visa/Mastercard cards as a form of payment.

Let’s explain how this cash flow process works through an example. Suppose a customer shops for €100 at Albert Heijn and pays with his credit card.

Once the credit card passes through Albert Heijn’s payment terminal, a signal is sent from Albert Heijn via Albert Heijn’s bank (Acquirer) for authorisation. Our bank (Issuer) checks our login details and determines whether we can fund this purchase. If our bank approves the transaction, Albert Heijn’s bank gives the shop the green light to complete the transaction. Albert Heijn’s POS (point of sale) prints a receipt, and we can go home with our groceries. This whole process takes just a few seconds.

After leaving the shop, the clearing process of the transaction continues. Albert Heijn’s bank sends the purchase details to our bank to update our account and Albert Heijn’s accounts and determine how much our bank will pay.

Finally, the settlement process continues with Albert Heijn’s bank (Acquirer), and Albert Heijn is paid by our bank.

Albert Heijn then receives an average of €98 of the €100 paid. The €2 difference is the discount percentage collected by Albert Heijn’s bank to enable the transaction. Albert Heijn’s bank (Acquirer) has to pass on part of the €2 to other players in the ecosystem, also known as an interbank fee.

Our bank (Issuer) gets most of the €2 because they take on the credit risk they provide to us. Visa/Mastercard collects a small portion to act as a network between the two banks, on average between 0.2 and 0.3%. It is difficult to ascertain which financial institution gets which amount of the €2, as this is situation-dependent and difficult to ascertain.

Although Visa/Mastercard’s percentage in this example may seem small, together they process more than 300 billion transactions. As a result, the fees they receive are substantial. Because Visa & Mastercard only act as the network between banks and do not carry credit risk, along with the huge growth in bank card payments, these companies have become hugely profitable. In 2022, Visa realised profits of over $17 billion and Mastercard nearly $10 billion. This resulted in a market capitalisation of $514 billion for Visa and $387 billion for Mastercard (Market capitalisation on 8-12-2023). This means that today both companies are worth significantly more than the banks that once founded them.

Visa and Mastercard thus play a crucial role in our daily lives, and their impact cannot be underestimated. Without their presence, life would be considerably more complicated. Their role is reflected in significant profit generation, making Visa and Mastercard stand out as financial giants. With much of the world still relying on cash payments, promising growth lies ahead for these companies in the future.