'Developments in the field of sustainability are moving fast. Being part of that, helping clients get ready and making an impact, is something we are

Have you ever thought about becoming a professional accountant after graduation? In Hong Kong, if you, being a university graduate and no matter whether you are majoring in the accounting study, would like to enter the auditing profession, you could join a CPA

(Certified Public Accountants) practice to start your career. In Hong Kong, accountants who are authorized to sign auditor’s report are known as CPA (Practising) (which is also known as Licensed Auditor or Practising Accountants in some other countries). This qualification is granted by the Hong Kong Institute of Certified Public Accountants (HKICPA), which is the regulatory body of the accountancy profession in Hong Kong. A CPA can practice on his/her own as a sole practitioner or together with other CPAs to form a partnership. In addition, CPAs can also incorporate a limited liability company to practice in a limited liability form as Hong Kong currently still does not have any Limited Liability Partnership (LLP) structure.

As a result, CPA practices in Hong Kong can basically be categorized into 3 layers, namely the Big 4s and local practices at the two ends, with mid-tier firms in between. The size of Big 4s in Hong Kong ranges from 1,000 to 2,000+ staff; while smaller local practices can be as small as only having one partner and few staff members. For mid-tier firms, their sizes can be ranged from 30~40 people to over 1,000 people; while the more typical size is between 70~80 and 200~300. In addition, these mid-tier firms can further be sub-divided into whether they are associated with an international network.

In this article, we will illustrate from the perspective of a mid-tier firm with international background in Hong Kong, Mazars CPA, to see what a university graduate can learn and be exposed to as well as how one can develop after joining a CPA practice and become a real professional accountant.

Structure of a CPA Practice

Mazars in Hong Kong has a total of about 280 people which is a typical size of a mid-tier firm here. Apart from the largest Audit and Assurance Department which provides auditing and related assurance services, it also provides services like taxation compliance and advisory, business risk review, forensic accounting, company secretarial, insolvency and liquidation as well as accounting outsourcing (see Chart 1 below). This also applies to most of the CPA practices in Hong Kong (or elsewhere in the world); they will provide a wide range of accounting related services to suit their clients’ needs. Mazars has its worldwide network in over 71 countries which enables us to serve clients with business and operations spreading over the world as nowadays most businesses do not only exist in one single city or country.

Chart 1: Diversified services offered

Working in an Audit Department

Although you can choose to join different departments in a CPA practice to start your accounting career, most will start from Auditing. In Hong Kong, unlike many European countries and in the US, audit is mandatory for all limited liability companies incorporated in Hong Kong irrespective they are public or private entities. This explains why auditing division is normally the major and most important service for most CPA practices in Hong Kong. Indeed, Audit Department normally recruits freshmen from universities every year.

Once you join the Audit Department as a freshman, you will have the opportunity to expose yourself in the business world through your role as an auditor.

In the Audit Department, you will usually be engaged and involved in audit assignments. Auditing is the highest level assurance given by a CPA, and therefore, as mentioned above, only authorized persons are eligible to sign an auditor’s report in order to ensure the quality of those authorized persons. In order to sign off an auditor’s report expressing an opinion on a set of financial statements, auditors are required to follow certain detailed requirements and procedures from considering to accept a new audit client, through the planning and execution of auditing procedures and to the completion and issuance of an auditor’s report, including its format. This set of standard requirements and procedures are known as Hong Kong Standards on Auditing (HKSA) in Hong Kong which is fully converged with the international standards which are known as International Standards on Auditing (ISA). The objective of the standards is to ensure that the opinion given by an auditor is consistent and of high quality of assurance.

When you are assigned to an audit engagement, you are required to understand the client’s business, the environment in which it operates and its operations & systems of control. In addition, you have to analyze the risks associated with the entity and design sufficient appropriate auditing procedures to address these risks in order to ensure there is no material misstatement contained in the financial statements we are going to express an opinion on. This really gives you chances to gain not only accounting and auditing knowledge but also business exposures.

Although audit assignments are strictly bound by the HKSA/ISA and each engagement should follow closely all the required approaches and procedures, you could still learn different types of knowledge and skills when you are involved in auditing entities in different types of business and industry. Taking inventory count as an example, is a very common auditing procedure to verify the existence of inventories. However, the skills to be used in different industries will be different and the experience gained will also vary. Imagine you are counting inventories in the warehouse of a production plant of a manufacturing company and in a retail shop selling luxury goods on the high street. Not to mention bank notes in a bank, coal in a power plant or cows in a farm. Your exposures to business knowledge are therefore enhanced when you are involved in the audit of various types of industries.

Apart from audit engagements, you may also be involved in other nature of assignments such as due diligence reviews and investigations. As these types of assignments are not strictly bound by the auditing standards, they would bring different exposures to you as the scope of these types of assignments normally needs to be tailor-made for the client’s needs. This requires a clear understanding of the client’s objectives of the engagement followed by thorough discussions with them and agreement of scope in order to deliver a useful and relevant result for the clients. This gives you the chance to see things from a different perspective.

Characteristics of Audit Assignments

In general, an audit assignment to be undertaken by you as a more junior auditor (Assistant Manager or below, see Chart 2 below) has the following characteristics.

1. Project basis: You will be assigned to an audit assignment for a fixed term of period ranging from a few days to 1 or 2 months depending on size and complexity of the engagement. In Mazars Hong Kong, the most typical duration for an audit assignment ranges between 2 and 4 weeks. You will be engaged in one assignment during a particular period and then be assigned to another after the completion of the existing one. You will work on one assignment at a particular period of time.

2. Team work: You will work with other staff members in an audit assignment. This is because staff with different levels of experience and expertise is required to undertake the work in an assignment. A team is therefore formed to ensure sufficient and appropriate resources are being allocated to complete the assignment properly. The team consists of different grades of staff (the components of which depend on nature and size of the company) which is normally led by a senior or Assistant Manager acting in the capacity of auditor-in-charge (AIC) who will report directly to the manager. After completion of review, the manager will report to the director/partner who will take the ultimate responsibility for the signing off of auditor’s report. You will work with different people in different assignments.

3. Working at client’s premise: As auditing procedures involve principally inquiry of information from the management and staff of the company, checking of documents as well as physical inspection of assets, you will normally work at the client’s office. This will ensure the designed auditing procedures can be effectively and efficiently carried out. You will spend most of your working time away from your own office.

Career Development

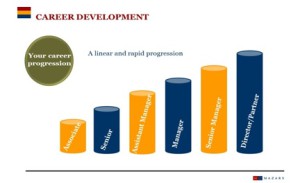

In Chart 2 below, you can see the career path for an audit staff starting from a freshman to becoming an executive in a CPA firm. Although titles used by different firms (not only those in Hong Kong, but also overseas firms like those in Europe and the US) may vary a bit, the roles and responsibilities are very similar. In general, we can divide these into 4 stages.

Chart 2: Career path of an audit staff in Mazars HK

1. Stage 1 (Associate): During this stage, you are normally required to perform tasks assigned by your seniors with close monitoring from them. The tasks are relatively simple and require less judgment to be made. For example, checking & verifying supporting documents, physical inspection of inventories and other assets, arranging confirmations to banks, suppliers and customers. This is more a learning stage for you to provide support to your seniors and cumulate basic auditing knowledge.

2. Stage 2 (Senior/Assistant Manager): After approximate 2 years’ experience as an associate, you would probably be advanced to this stage as a senior, then as an Assistant Manager (AM). With accumulation of basic auditing techniques, you should now be able to work on your own and gradually be able to lead a small team of staff to complete an audit assignment. You will normally act as the AIC of an audit assignment and will be responsible to plan and execute most of the audit works and directly report to managers/senior managers. At this stage, not only technical knowledge is important, certain supervisory and managerial skills are also keys to your success for further advancement.

3. Stage 3 (Manager/Senior Manager): Once advanced to manager, your roles and responsibilities will change significantly. Now, you are required to manage a portfolio of clients and report directly to a director/partner. A manager (including senior manager) is responsible to plan audit assignments ahead, liaise with clients in relation to timing of work and other reporting requirements such as achieving deadlines for reporting, allocating sufficient appropriate resources to conduct the audit work as well as monitoring the work carried out by subordinate staff members.

4. Stage 4 (Director/Partner): A director/partner is responsible for the signing off of the auditor’s report in an audit assignment. As mentioned above, you should now be authorized to sign such report under the title of CPA (Practising) in Hong Kong granted by the HKICPA. Apart from handling audit and assurance assignments, you may also be involved in other management functions in a practice such as technical & training, business development or internal management.

Conclusion

Indeed, being an auditor is very challenging and dynamic job. It is definitely not as boring as many other people think. You need to be diligent, business-minded good at communication in order to become a successful auditor. In addition, it is also good for you, being a university graduate, to start your career in a CPA firm whether your ultimate goal is becoming an accountant as experience to be gained in those early years of the career not only give you a solid foundation of accounting knowledge, but also give you a taste of the business environment you would face in many years of your career to come.