Disclaimer: This article examines a particular investment strategy. The article and calculations have been made with care, but we cannot guarantee the accuracy of any calculations. Investing involves risk and this article should not be taken as financial advice of any kind.

Everyone who started studying on or after 1 September 2015 has had to deal with it: the loan system. The basic grant was abolished. Not to worry, instead of a grant students could borrow from the government at a favourable rate. Moreover, this loan would initially not affect your mortgage later on. As of the academic year 2023, this system will be abolished again and the basic grant will return. In this article, I examine the advantages of taking out a maximum loan during the loan system and investing what you don’t use. In this article you will find out whether you could have turned your debt into an asset (or have already done so).

Research plan

As an example I will take a student who studies for 5 years: from academic year 2017/18 until 2021/22. This student borrows the maximum every month and invests everything he or she has left after paying, for example, rent, clothes and free time. I look at the value of this investor’s portfolio on 1 May 2022 on the basis of the value trend for 3 different investment objects: the AEX, the S&P 500 and Bitcoin.

Between September 2017 and September 2022, a student could borrow, on average, a maximum of EUR 1059 per month. Research by the NIBUD shows that in 2017 students borrowed an average of 559 euros, compared to 526 euros in 2021. This means that the average student borrowed 543 euros per month and could have borrowed an additional 516 euros per month to invest. A total of 28,380 euros between September 2017 and May 2022. Using RStudio and price information from Yahoo Finance, I simulated a portfolio for three investment objects. The first object concerns the Dutch AEX index.

AEX

The AEX contains the 25 companies with the highest market capitalisation that are traded in Amsterdam and is the best known stock exchange in the Netherlands. The graph below shows the development of the AEX with a monthly deposit of €516. In all calculations it is assumed that all dividends are reinvested.

In this index the final value of your portfolio is €34,252. In other words, a profit of €5,872 on your deposit. A nice amount, but you can ask yourself whether this is worth it when you consider the maximum study debt and the consequences of this for getting a mortgage.

“The S&P 500 did a lot better than the AEX between 2018 and 2022.”

S&P 500

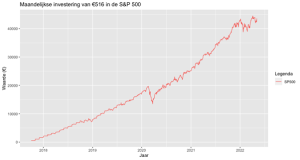

You can also choose to invest on the American stock exchanges. The most well-known is the S&P 500, which reflects the value of the 500 largest companies traded on US stock exchanges. To make the investment in this index comparable to that in the AEX and to avoid problems with the conversion from euro to dollar, I calculate the value of the portfolio by looking at the returns of an ETF that trades in euros and reinvests all dividends. Curious about what an ETF is exactly? Wout explains it in this article!

The S&P 500 did a lot better than the AEX between 2018 and 2022. The final value of an investment of €516 per month in this index is namely €42,724. A profit of €14,344 on the total investment.

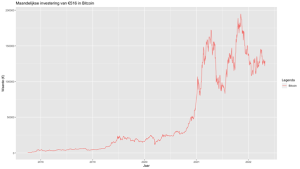

Bitcoin

As you can see, the value of this strategy is very volatile. The final value is €124,808, a profit of €96,428. However, there is a lot of uncertainty involved. As the chart shows, this portfolio lost almost half of its value in the second quarter of 2021. It is difficult at times like these to keep a cool head and stick to the intended strategy.

Conclusion

Below you can see all three strategies in one graph, which shows the differences in value development between the different strategies. Here you can see once again how stable the value of the AEX and S&P 500 is compared to Bitcoin.

In the end, all strategies are profitable, but you will have accumulated a total student debt of €58,245 by May 2022. When investing in Bitcoin, it is clear that you have made a good investment, being rewarded for the risk you have taken. For the S&P 500 and AEX, it is true that you can earn a nice amount, but it could just be that, because your student debt will count towards your mortgage, you are better off with a lower student debt. I leave it to the reader to make this assessment.