If you look at the recent world developments, you cannot deny there are a whole lot of problems. Look at our neighbours; Boris Johnson has taken over the command of the United Kingdom and is leading Britain to leaving the EU on the 31st of October. Mario Draghi, head of the ECB, predicts a long period of low economic growths and is keeping the interest rates artificially low. His successor Christine Lagarde will, with high probability, continue his policies. These choices are not without dispute. The head of both ING as the Dutch Central Bank have criticized the ECB for its low interest rate policy. On the other side of the Pacific Donald Trump might be ousted from office if the impeachment inquiry continues. Furthermore, the Trade War between China and the US is continuing, oil ships are taken hostage, oil processing plants bombed and the riots in Hong Kong are also going through for the fifth month so far. One would think these situations are enough to warrant a negative sentiment on the stock market.

‘The only logical move seems to sell everything.’

Despite all of it, the stock markets have risen last quarter. A&F Investments also kept a level head. Especially in periods of chaos it is important to stay critical and sharp. Look at your stocks and ask yourself, what is the impact of these events on this company? For most companies, the consequences are low. As long as you don’t have a large exposure to the UK and the US, it is rewarding to stay invested. Especially with the low interest rates, which draws more people to the stock market rather than to saving. A stock market bust is always possible, but remain calm and estimate the value of your holdings. If anything, it is always possible to buy more!

A&F Investments only executed two transactions last quarter. Firstly, we sold our shares in Flow Traders. We bought Flow Traders as an insurance policy against volatility, as this company earns more when markets move and the volume is higher. However, the company did not move enough to satisfy this strategy, so we sold our shares. Secondly, we bought a few shares of Takeaway.com. This company is relatively new on the market and we believe it is a winner in the food delivery market in Europe. A market that is growing quickly. We believe the company can benefit from network effects as long as they stay the leader in Europe. A&F Investments had a return of 3.5% last quarter. We outperformed the S&P500 with 2.5% and the AEX with 0.2%. A great result!

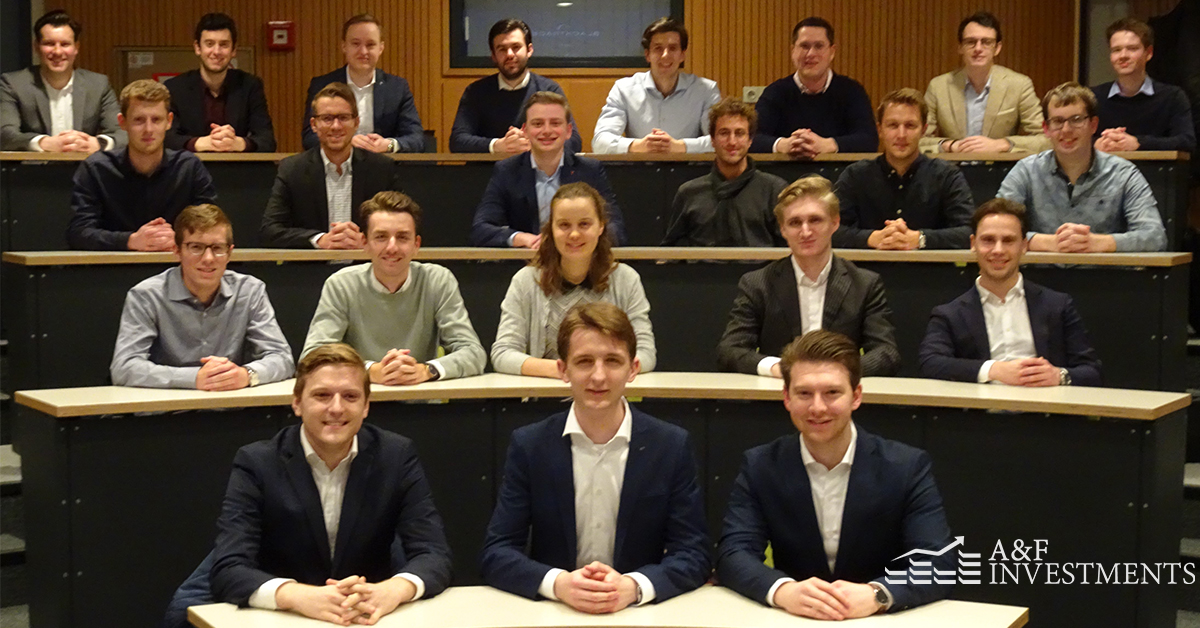

In September, we actively promoted the committee and as a result we have welcomed 18 highly motivated members to the group. The committee is now operating at full capacity, with our maximum number of thirty students. Moreover, we started a cooperation with a Norwegian student investing committee, with the goal of exchanging information and contacts. Finally, we will welcome FDI for a guestlecture upcoming quarter. The upcoming year seems very promising for A&F Investments!