For the Dutch version, click here.

Disclaimer: This article does not contain investment advice and aims only to entertain and inform.

Traditional investments such as stocks, bonds and real estate are not the only options available to investors. Alternative investments are emerging as an interesting and versatile way to build an investment portfolio. This article will examine different types of alternative investments and discuss their benefits and risks.

Classic Cars

Many people think that spending a capital on a car is excessive. Especially since cars depreciate in value on average between 10 and 20 percent each year. Still, not every car is a bad investment, as there are plenty of cars that increase in value.

For example, we go back to Italy in 1977. A proud owner of the 1962 Ferrari 250 GTO was told by his wife that the car was making too much noise and was forced to sell it, the market value was around $71,000. Meanwhile, the same car is being auctioned for $50,000,000. Another example is the 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe, which was auctioned last year for $149,000,000 (Harshvardhan, A, 2023).

The best-known example of cars increasing in value is classic cars. Although experts still debate this, a car is called classic when it is at least 20 years old and of historical importance. These can still be divided into vintage and antique cars. Vintage refers to cars made between 1919 and 1930. Antique cars were made just before 1919, during the so-called “Brass era,” which refers to the large amount of metal used to make these cars.

To give just one example, vintage cars have increased 185% over the past decade ( Piovaccari, G & Za, V, 2023).

Still, determining the market price of a car seems difficult at first. Fortunately, Hagerty, an insurer in classic cars, has the solution to this. The firm tracks the value of classic cars in a clear guide. Each model is given a figure based on its condition.

Nevertheless, there is a lot of uncertainty involved in buying a classic car. Although Hagerty’s gives a good indication, there is no guarantee that the guide is completely accurate. In addition, unlike stocks or bonds, a car is physical. Therefore, a garage, for example, must be considered, which entails additional costs, and insurance for classic cars is quite expensive. In addition, this makes the investment a lot less liquid, since it remains to be seen how quickly a buyer can be found. Also, a relatively large capital is needed to profit from possible price increases. However, there is now the possibility of investing in classic cars without physically buying them. There are several funds where investors can invest in classic cars. An example is Azimut, however, investors must put in a minimum of $140,000.

“Where should I start if I want to invest in art?”

Art

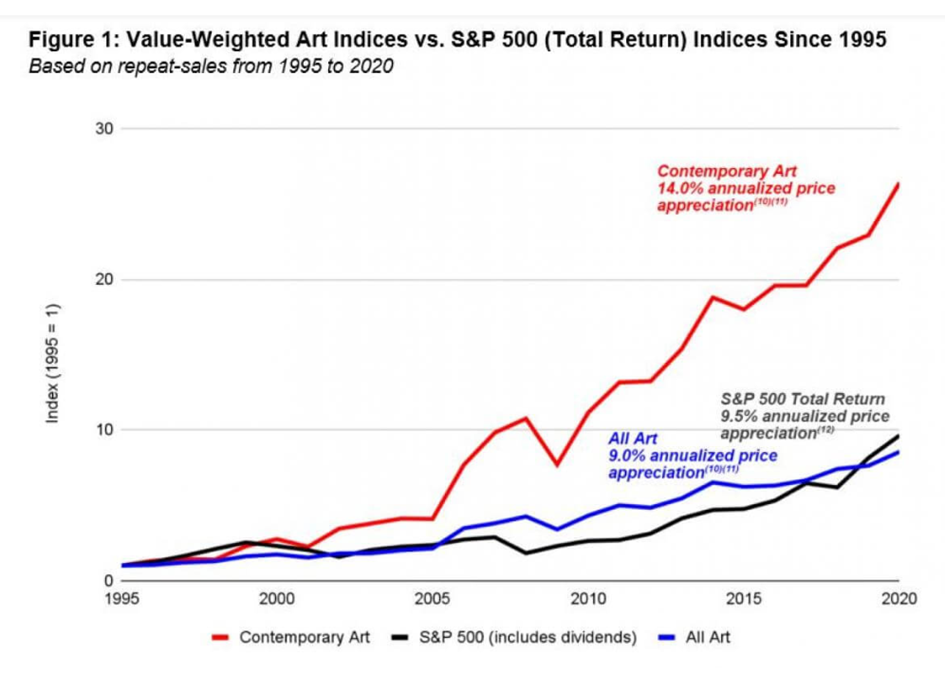

In addition, investing in art is an interesting option that is becoming increasingly popular. In general, art is seen as a fairly safe investment, as its value has gradually increased over the past few decades. The chart below shows that “Contemporary Art” is rising at an average annual rate of 14%, which is considerably higher than the S&P 500. “Contemporary Art” includes works of art where the artist is still alive.

This positive growth is also noticeable among wealth managers, where only 55% in 2014 thought art should be part of an investment portfolio, this percentage to 78% (Deloitte, nd). Nevertheless, art makes up only 2% of all investment portfolios. Thus, there is still plenty of room for growth.

The most logical reason that art performs above average is because of scarcity This is also the main reason why the original is (and always remains) worth more than fakes. This also explains why a certificate of authenticity often accompanies the original of famous paintings.

Furthermore, there are also other factors that determine the value of a painting. For example, the quality of the canvas is essential and an artist’s signature on the artwork further increases the value.

Still, of course, the question remains: where should I start if I want to invest in art?

As Warren Buffett always says, “Invest only in what you understand.” Try to gather as much information as possible about the art world, read books and do online research. Furthermore, it is wise to visit museums and expand your network in this world as much as possible and view it as a long-term investment (Atelier, 2022).

One of the drawbacks, however, is that works of art, like cars, are not liquid. Should a work of art have increased in value and you, as an investor, want to profit from this, it remains to be seen whether a buyer can be found in the short term. Fortunately, you can also invest in art through funds, such as Masterwork. This does not require a minimum deposit. Another disadvantage is that most of the return comes from the relatively expensive works of art, but these are traded through large auction houses. The problem with this is that the transaction costs are comparatively high and therefore the returns are generally low.

Watches

Investing in watches can also be an interesting option for people interested in collectibles and valuable items. Watches can increase in value over time, especially if they are produced by reputable watch brands in a limited quantity.

When investing in watches, it is important to pay attention to the quality of the watch, its condition and the demand for the brand and model. Material of the watch, the completeness of the set (original box and papers) and the condition of the watch are also important. Some collectors prefer vintage watches, which in many cases are rarer and thus can fetch higher prices.

It is also important to invest in watches released by reputable brands, such as Rolex, Omega, Patek Philippe and Audemars Piguet. These brands have a long history of producing quality watches and have built a strong reputation over time.

Finally, it is crucial to know where you are buying the watch and from whom. It is advisable to invest in watches sold by reputable watch dealers or auction houses, which offer guarantees about the authenticity and condition of the watch.

It is important to remember that investing in watches is not without risk and the outcome depends on several factors, such as supply and demand, economic conditions and market trends. It is therefore wise to seek advice from experts in the watch industry before deciding to invest in a watch.

General advantages of adding alternative investments to your portfolio is that it provides diversification and can ensure that higher returns are achieved. However, it is important to understand the associated risks.

References

Atelier, 2022, How to invest in art for beginners, Retrieved from https://www.artelier.com/post/how-to-invest-in-art-for-beginners-why-art-is-a-good-investment-in-2022#:~:text=A%20long%2Dterm%20reliable%20investment,value%20based%20on%20market%20fluctuations.

Harshvardhan, A, 2023, Ferrari Mania? Retrieved from https://www.transcontinentaltimes.com/ferrari-azimut-invest-classic-cars/

Piovaccari, G & Za, V, 2023, Reuters, Retrieved from https://www.reuters.com/business/autos-transportation/ferrari-fever-classic-cars-roar-into-investment-funds-2023-04-15/