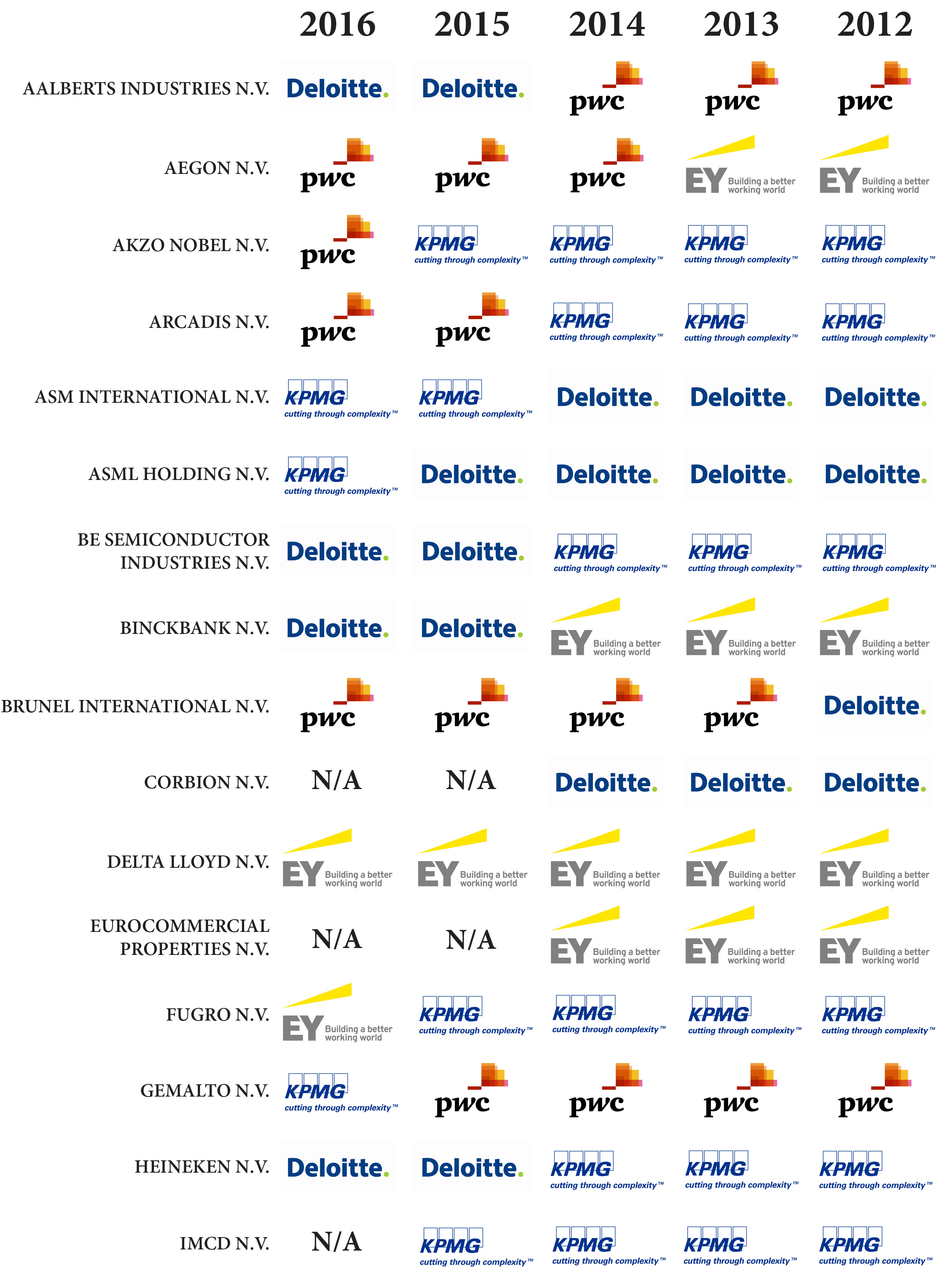

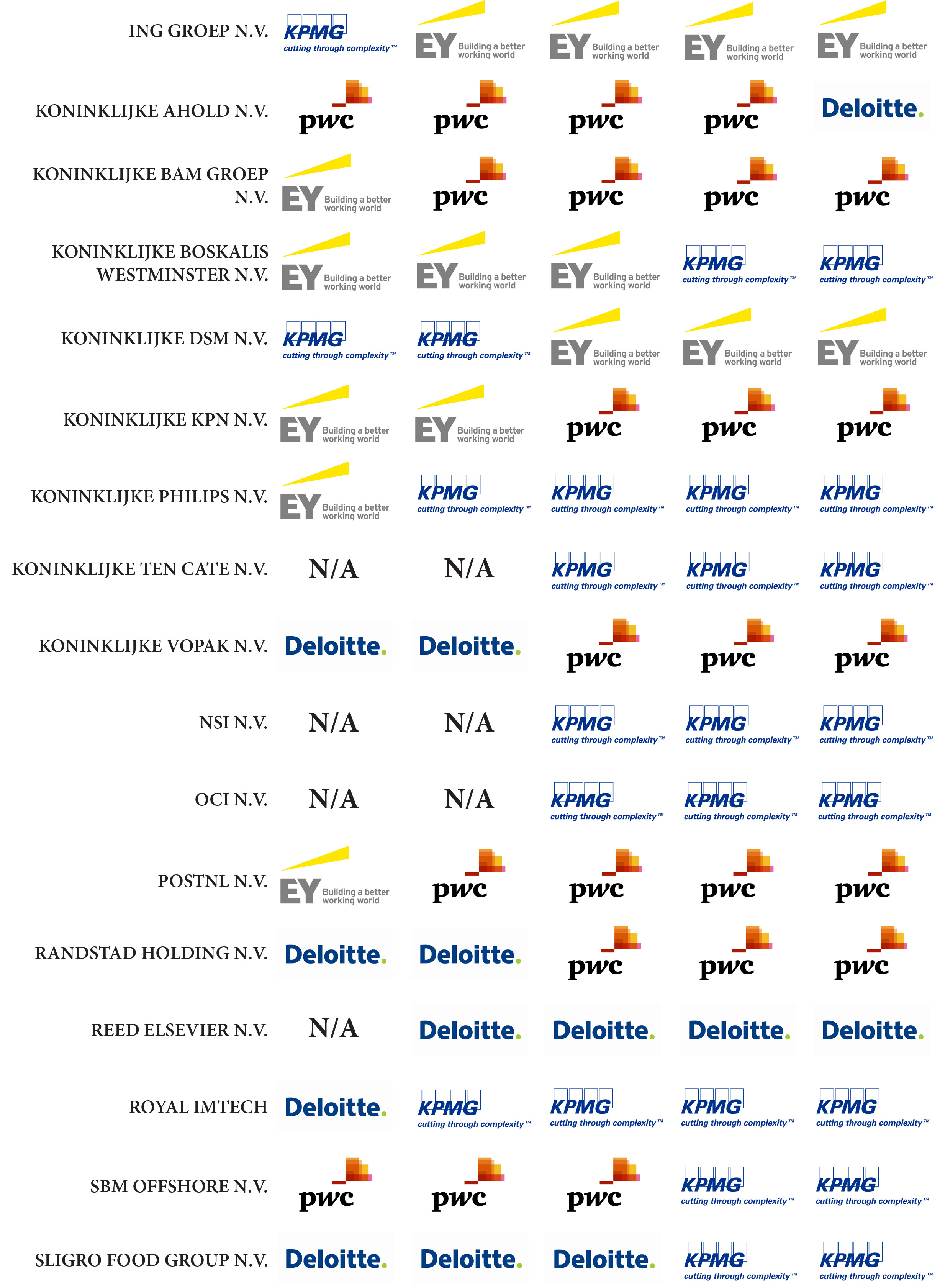

Overview Dutch listed companies and their external accountant (Deloitte, EY, KPMG or PwC).

Public interest entities, in the Netherlands referred to as OOB’s (ondernemingen van openbaar belang), are obligated to rotate of audit firm after a period of 10 years from 1st January 2016. OOB’s include Dutch publicly listed (at a European stock exchange) companies, insurance companies and banks. Naturally a tensed discussion has risen between different parties. Most OOB’s and audit firms are not pleased with the future obligation to rotate and claim it will do more harm than good on their quality of financial reporting. The government is determined to implement this new rule to increase the quality of financial reporting.

OOB’s and audit firms claim that it is costly to change audit firm and quality will be lost. Quality, they say, will be lost due to the fact that the new audit firm isn’t as capable as the former audit firm from the start to conduct a high quality audit. It will take time to gain the required knowledge about a company to conduct a high quality audit and therefore high quality financial reporting. Others, mostly political parties, argue this statement and claim that rotation will increase independence of audit firms and OOB’s and therefore improve the quality of financial reporting.

Below you can find an overview of the first changes that have already taken place due to the mandatory audit rotation:

*No liability accepted for errors. If you find any errors or have more information about upcoming changes please contact us via info@asset-accountingfinance.nl.