In this article, both Stijn and Sebastiaan discuss their roles as a board member of Asset | Accounting & Finance. First, Stijn will talk more

It is a common consideration: I want to get a decent return on my money, but I think the timing is bad at this point in time. Economic uncertainty, poor economic cycle timing, deflation risk, inflation risk, there is always a reason not to invest your money at any moment in time. Wouldn’t it be great if there was an investment framework that is theoretically robust to the shocks that we fear and which hold us back in getting a decent return on our money? After all, receiving only the savings rate the banks offer you goes along with huge opportunity costs in the long run.

To find a solution to the given problem, Bridgewater Associates asked itself the following question: “What mix of assets has the best chance of delivering good returns over time, through a wide range of economic environments we could experience?” and as a result came up with a framework that in essence is designed to harvest the Risk Premium without taking any viewpoint on the future economic climate. This way, the portfolio gives a return that is robust to the economic climate, whether the economy is in decline or booming, it basically gives a feasible return as carefree as possible.

How does one construct such a portfolio? Let’s dive into some basic economic formulas and observations. From historical data we know a few things that this framework relies on: Asset classes outperform cash in the long run, and Asset prices discount future economic scenarios. The present value of future cash flows in assets is computed with the following formula:

![]()

The Risk Premium is a compensation for risk. This compensation is essential to the capitalist system, and it varies over time. The expected future cash flows as well as the Riskfree rate and the Risk Premium are expectations that change over time. Asset prices adjust accordingly.

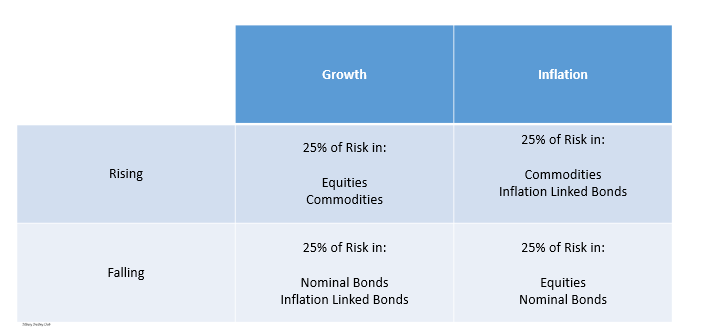

In order to harvest the risk premium, one must construct a portfolio that is robust to all different economic climates while still being invested. In order to do this, let’s assess four basic economic climates: Rising Growth, Rising Inflation, Falling growth and Falling Inflation. Dividing the total risk of a portfolio equally over these four situations gives a super robust return that is reliant on the risk premium more so than anything else. In order to do so, picking assets that perform in these specific situations and assigning a part of the risk of the total portfolio to each of those asset classes is the way to go.

Firstly, we consider the most obvious asset class: Equity. When does equity perform best? Considering our formula: Equity discounts future cash flows. If growth is rising, future cash flows gain in value and P is more favorable. Secondly, in times of falling inflation, the discount factor of future cashflows is more favorable for the present value, therefore, equity is also great in times of falling inflation.

“Dividing risk equally over these three asset classes gives a well-diversified portfolio.”

What’s next? Another obvious asset class: Nominal bonds. What happens to those when growth is falling? As returns on equities drop, the value of fixed return increases. Therefore, nominal bonds are a good asset to have in times of falling growth. What’s more, when inflation drops, the discount factor of the future cash flows from nominal bonds decreases, adding to the present value of nominal bonds.

The last common asset class that is fit for this strategy is commodities. Commodities obviously increase in value when inflation is rising but what about a growing economy? Demand for commodities is strongly related to industrial demand, which peaks in times of economic prosperity. Due to the additional demand, commodities also become more expensive and therefore increase in value.

Dividing risk equally over these three asset classes gives a well-diversified portfolio, but one more asset class is necessary to properly conduct the strategy. What about times when inflation is rising, but growth falters? Commodities will benefit from the increased inflation, but are hurt by the decrease in demand. Bonds are happy with the falling growth, as their fixed returns become more valuable, but the increased inflation hurts their present value. Equities lose out on both ends. The solution: Inflation linked bonds. Inflation linked bonds are a type of bond that is indexed to inflation, therefore protecting buyers against the inflation risk while still having a coupon return. These bonds are tied to inflation, so naturally they perform well in rising inflation. Also, because of the fixed return (besides its link to inflation), these are strong in times of falling growth. The following matrix shows a way to divide asset classes to get the sought-after results:

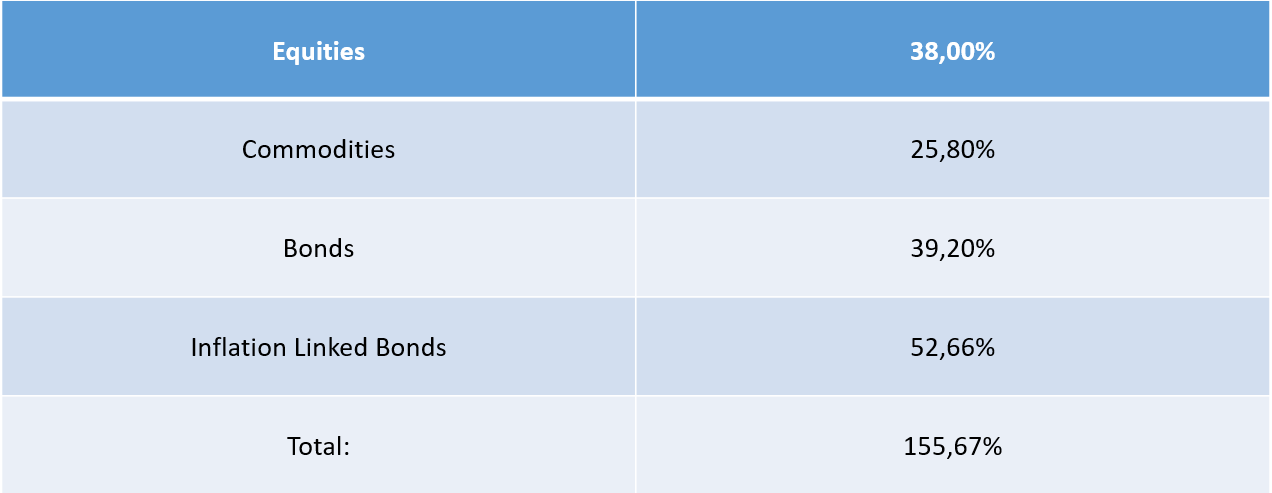

In order to get the asset allocation right, the strategy aims to be exposed to equal amounts of risk for each basket. Optimizing this based on annual volatility of each of the asset classes will give an asset allocation that will look something like this[1] :

One can decide to take a certain amount of leverage on the portfolio, based on personal risk appetite. This way, you can actually gain a strong return without being (theoretically) exposed to the most basic risk factors asset investment exposes you to.

To summarize: In order to gain an expected return as steady as possible based on four basic economic situations, rising growth, rising inflation, falling growth and falling inflation, and an asset allocation based on four asset classes Equity, Commodities, Nominal Bonds and Inflation Linked Bonds in a specific ratio will give you a very safe yet good expected annual return. There is a lot of room for personalization for whatever desires you have, such as a different leverage to expose yourself to a bit more risk, but getting a higher return in return.

Author: Rob Donkers, with a lot of thanks to Guido van Poppel.

Note: This strategy is in no way, shape or form originated by me. This is just an informative article on a very interesting approach to investing.

[1] To take it one step further, you can also consider how much time the economy generally spends in each of the four baskets, slightly changing the allocation from equal 25% parts to tweaked 23% – 27% parts.