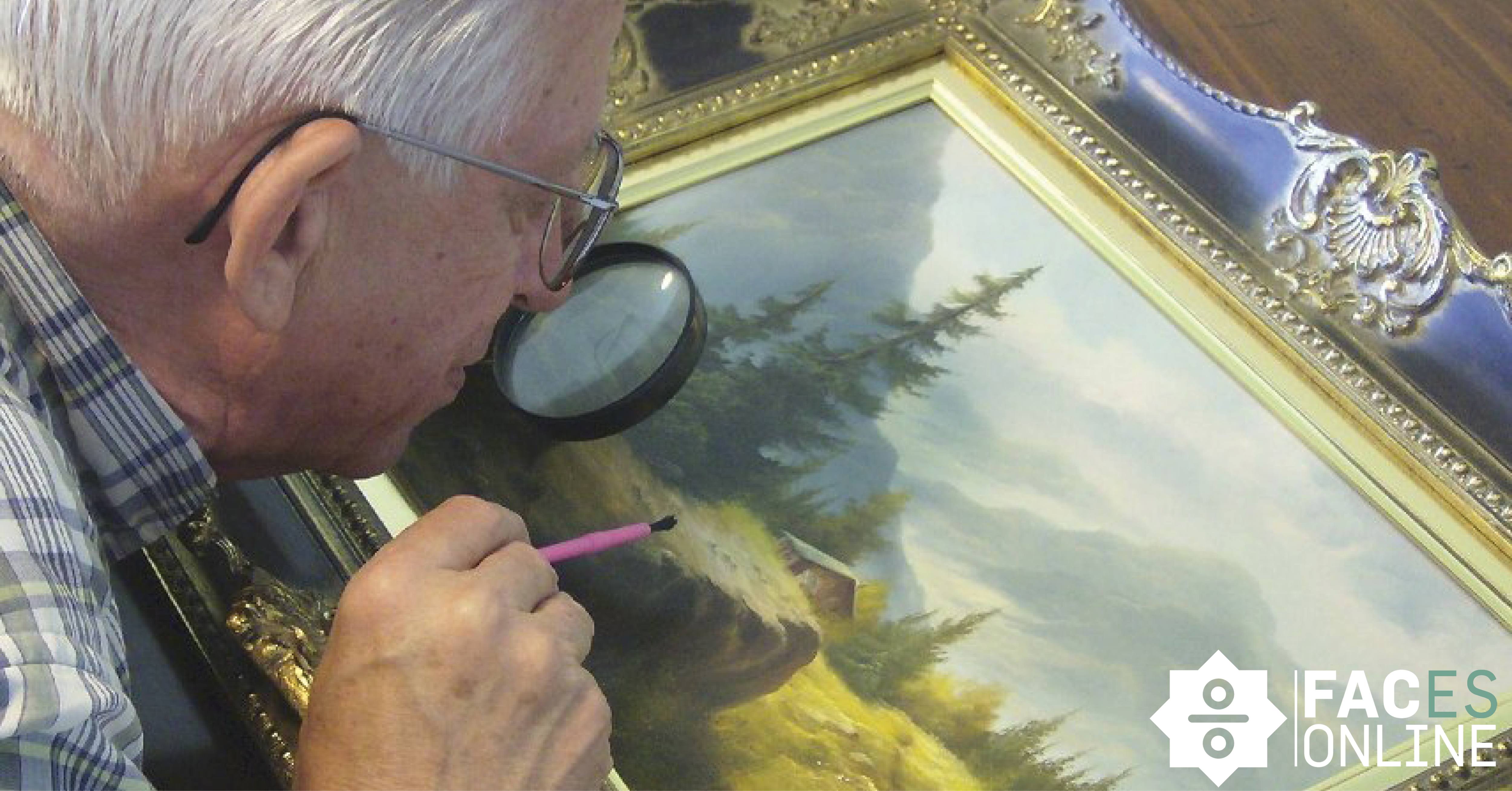

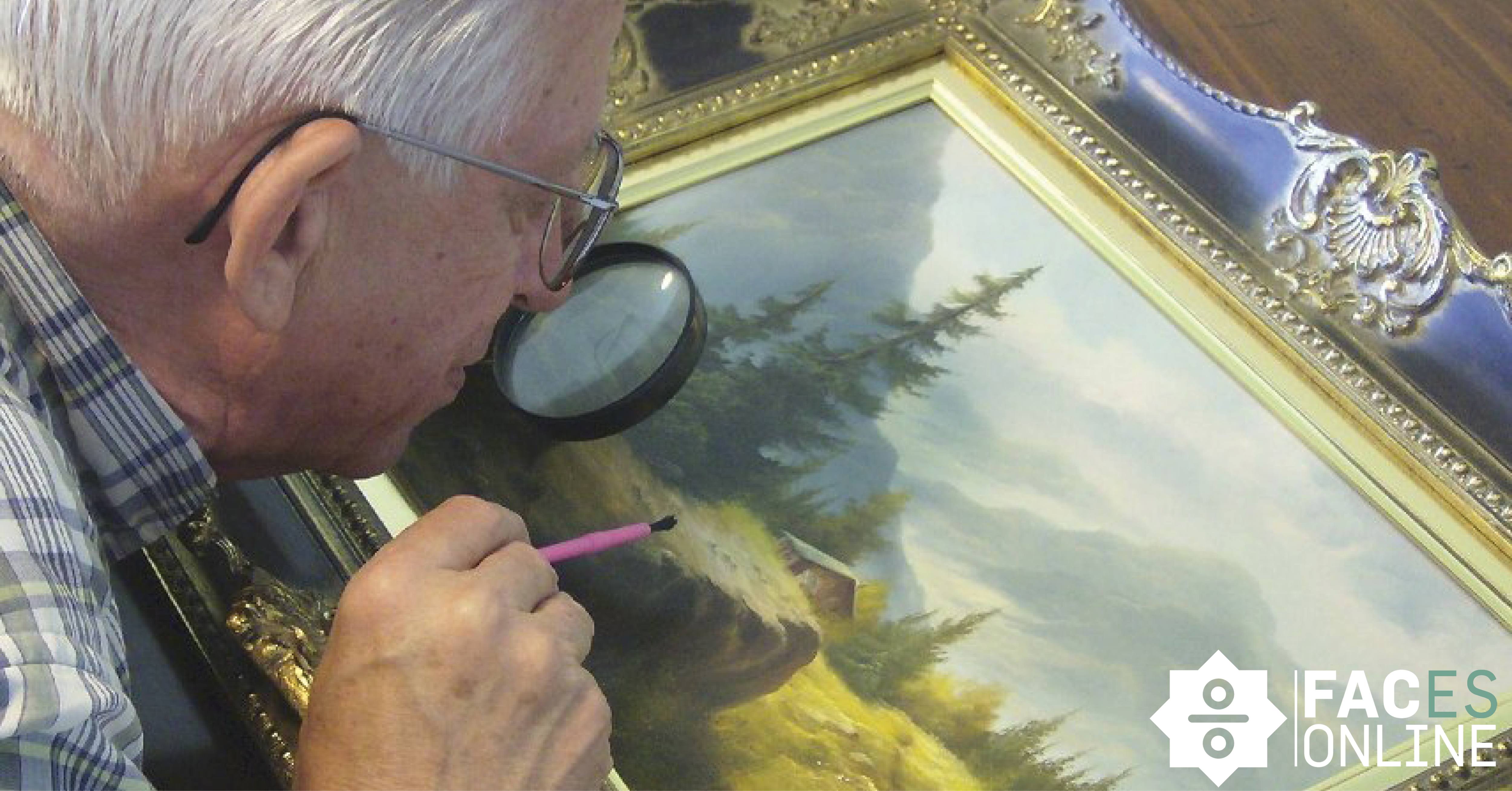

For the Dutch version, click here. Is art even a considerable asset class? In 2020, the total value of global...

For the Dutch version, click here. Is art even a considerable asset class? In 2020, the total value of global...

For the English version, click here. Disclaimer: This article does not contain investment advice and only aims to entertain and...

For the Dutch version, click here. In this article, Dhiraj talks more about the world of sports betting and the...

For the Dutch version, click here. Who are you and what do you do at KPMG? My name is Thomas...

For the Dutch version, click here. Who are you? My name is Tim Foesenek. I grew up in Rijsbergen and...

For the Dutch version, click here. Veerle Vanlaerhoven started working at Van Oers Accountancy & Advies in 2020 as a...

Wij zijn te bereiken op bovenstaande momenten.

© 2025 Faces-online.nl by Asset financials