For the Dutch version, click here. BlackRock is the world's largest asset manager, founded in 1988 and based in New York City. It manages

Recently, AkzoNobel (Akzo hereafter) has been in an unstable situation, mainly due to the fact that the company has been involved in a takeover battle with PPG. This resulted in many offers, lawsuits and political debates in the Netherlands. At its highest level, the deal had a value of around €26.3bn which was equivalent to €95 per share, while the share price was €74.3. This was equal to a 27.79% premium. PPG dropped the takeover deal in the beginning of June, since this was the deadline set by Dutch law to make a final offer. It seemed the battle was over.

Following this period, the main question was how Akzo could keep its shareholders satisfied. Consequently, Akzo set higher performance targets, promised extra dividends to shareholders, and made promises to sell a major chemicals subsidiary to please its shareholders. However, one of the major Akzo shareholders, named Elliott Advisors (Elliott hereafter), forced Akzo to talk with PPG. Eventually, this aggressive behaviour led to a loss in the Amsterdam Enterprise Chamber. The aggressive behaviour was also visible in Elliott’s stake in Akzo. Elliott’s stake increased from 3.25% to 9.5% following the takeover battle.

Even after the loss in the Amsterdam Enterprise Chamber, Elliott continued to increase its pressure on Akzo, as the company demanded an extraordinary shareholder meeting with the main intention of firing the chairman of the supervisory board, Anthony Burgmans. Elliott accused Mr Burgmans of blocking the PPG – Akzo takeover. In the end, Akzo was in a rocky situation, especially because its CEO Ton Büchner resigned and was replaced by Thierry Vanlacker, who only joined the company in 2016.

The Axalta Deal

On October 30th, Akzo confirmed it was in a discussion about a potential merger between the AkzoNobel paints & coatings business and Axalta. This would create a leading position for the company, especially due to the fact that Axalta fills an empty space in its portfolio. A merger of Akzo and Axalta could result in a $30bn company. Furthermore, the company stated that the split-off of the speciality chemicals subsidiary will stay on the agenda for April 2018 and is unaffected by the latest developments.

However, analyst Joost van Beek of Theodoor Gillissen mentioned that the timing of the Axalta deal will likely be tricky. This is mainly to do with the shareholders’ pressure on Akzo’s management to step back from the merger discussions, as most Akzo investors are aware of the fact that a merger with Axalta will result in a more defensive position for Akzo. As mentioned before, both companies combined could result in a $30bn company, which means PPG has to pay a higher price for a takeover to succeed. Axalta knows that Akzo wants to avoid a PPG takeover in the short-term. Therefore, this could result in Akzo paying too much for Axalta.

The Impact on the Share Price

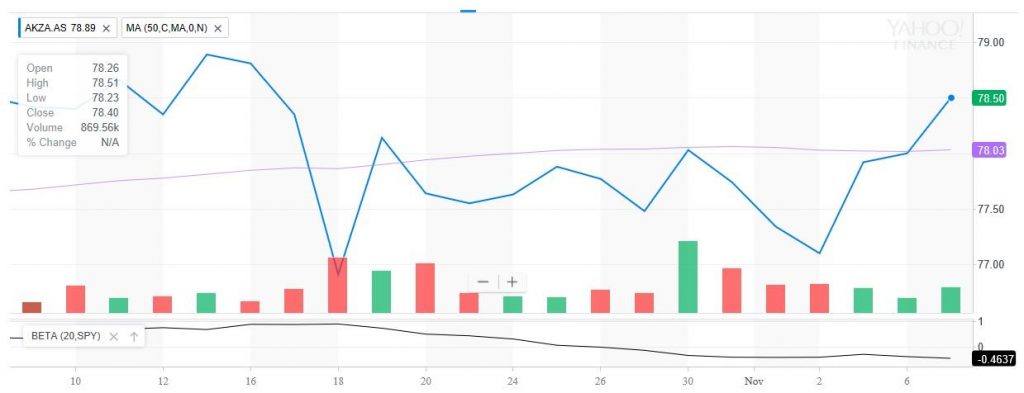

After the merge between Akzo and Axalta, the question is what the impact of this particular news event will be on the share price movement. The following chart shows the share price movement of Akzo over the past month.

Source: Yahoo Finance

From the above chart, it is visible that the potential news of merging had a positive impact on the recent share price movement. The share price shows a tremendous lift as soon as merging speculations came to the forefront on October 27th. The share price increased from €77.48 to €78.03 on October 30th. This is equal to a 0.71% increase in only two trading days. The large question after this positive share price movement is if the share price is going in a downward direction to adjust for the positive news element. This can be confirmed, as the share price decreased from €78.03 to €77.10 last Thursday, which is equivalent to a bounce-back of 1.19%.

Nonetheless, the share price has been in an upward movement since last Friday, as it increased to €78.50 on November 7th. The large question remains if merging discussions between Akzo and Axalta move to the next stage. It looks like investors still speculate on this outcome.

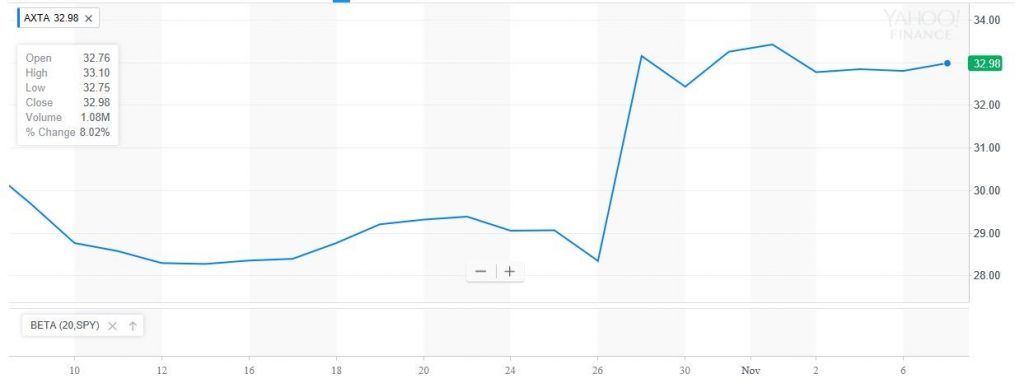

Furthermore, it is also worth analyzing the share price direction of Axalta before, and just after, the merging news came out. The share price direction of Axalta is visible in the following chart:

Source: Yahoo Finance

It surged from $28.34 on October 26th to $33.15 just one day later. This is equal to a share price jump of approximately 17%. During the post news period, the share price bounced back to $32.43 on October 30th, which is a small drop of 2.17%. Since October 30th, the share price has been fluctuating as a potential result of uncertainty regarding the future direction of the company, as the talk of merging is still on the table. In short, the impact the M&A news has had on the share price movement of the related companies is certainly notable.

Conclusion

The question is which direction the merging discussions will go during the coming weeks. It for sure is an interesting development to follow in the coming period. Akzo is still operating in a tough period and seems to move in a direction that makes the defence shield stronger for a potential takeover later this year.

On the other hand, Axalta and other potentials for merging are well-informed about Akzo’s current company status. Akzo seems to strengthen its defence for a potential PPG takeover later this year. There is a high chance that Akzo is scheduling additional M&A activities. Axalta and other target companies might be able to use this PPG takeover information to higher the price that Akzo has to pay for M&A. In the end, investors are recommended to closely follow Akzo’s developments until the end of 2017; there may well be some Christmas presents under the tree.