My name is Wout Grootte Bromhaar, 25 years old and living in Tilburg. In this ‘Just Graduated’ I tell you more about my job as Junior Business Controller at Homefashion group, the parent company of Leen Bakker and Kwantum. First of all, I will provide more information about my background and my choice for the Master Finance at Tilburg University. From pre-vocational secondary education to WO Master As you could have read from my last name in the introduction, I am not originally from Tilburg. I was born in beautiful Twente. I first did VMBO-TL in high school and, with a small detour via HAVO, HBO and a pre-master, I was eventually able to obtain my WO Master Finance in July 2022, which I am very proud of! This means that I did not do my bachelor’s degree at the university in Tilburg, but first studied Finance & Control at Saxion University of Applied Sciences in Enschede. I thought that was a very nice route, as I had already come into contact with the professional field through various internships and thus had my first introduction to Business Control (and yes, I was also able to earn some money, which as a student is of course a is a nice added bonus 😉). When I graduated from college, I was not yet ready to work full-time. This was partly due to my age (I wasn’t even 22 yet) and my drive to continue studying and get back into school. The pre-master Finance in Tilburg, the mandatory bridging program if you come from HBO, was very tough and cost a lot of blood, sweat and tears, but I was thrilled when I passed it and could start in August 2021. the master’s degree in Finance. Master Finance As you read before, I have a passion for Controlling. At the universities in Nijmegen or Groningen you really had master’s degrees specialized in Controlling, so I could have gone in that direction too. However, for me the Master’s degree in Finance immediately stood out, partly because you could choose your own subject package. In addition, I was able to learn more about mergers & acquisitions and corporate financing, which I was very curious about. Through various guest lectures I learned more and more what working in M&A entailed and the assignments certainly helped with this. An example I can give is that for the Financial Statement Analysis & Valuation course we had to create a company valuation for Basic Fit. I ultimately did my thesis on the performance of family businesses versus non-family businesses during the Covid-19 pandemic. I liked that my supervisor gave me a lot of freedom while writing my thesis. And through the course Empirical Methods in Finance I learned a lot about the STATA program, which was very useful during my thesis. Ultimately, I obtained my master’s degree in Finance within one year. Extended student life During my studies I became an active member of A&F, where I was the chairman of Faces Online and the Alumni committee. By attending various (in)formal activities I have made friends for life here. I can definitely recommend everyone to join an association, especially if you are not from the city. This way you get to know new people in the fastest and easiest way. However, I was unlucky that the world was in the grip of a pandemic with many social restrictions during my ‘student days’. It is not without reason that student years are in quotation marks in the previous paragraph. When I found my job in Tilburg, I decided to extend my membership at A&F by joining the Alumni committee. Even though I was already working, by remaining active in the study association, I was still able to catch up on student life by attending various activities that I missed due to corona. And yes, that sometimes cost some sleep when I had to get up early the next morning after a fun evening, but it was definitely worth it! Finding a job I have now been working as a Junior Business Controller for the Leen Bakker and Kwantum chains for about a year and a half. The decision to continue in controlling, and not to choose the M&A branch, for example, is also due to my previous experiences. For example, I worked at Aebi Schmidt for about a year in various positions. Aebi Schmidt is a production company in Holten (Overijssel) that mainly produces spreading machines. I started there as a graduate student at HBO and, between obtaining my pre-master’s degree and starting my master’s degree, I also briefly worked as a business controller. Then I experienced how cool it was to provide the business with management information through dashboarding (In Excel or Power BI). Building, analyzing and reporting gave me such energy that I knew I wanted to continue in this direction. Soon after graduating, I noticed the vacancy of Junior Business Controller at Homefashion group. After 2 good conversations with, among others, the Business Control manager and CFO, I discovered that the culture within the company certainly suits me and the work appealed to me, which made it a very easy choice to work at this company. A choice that I have certainly not regretted so far and 1.5 months after my defense the first working day could start in September 2022! My daily work at Kwantum & Leen Bakker The nice thing about Business Control is that you are really a spider in the web. You deal with different departments and facets within the organization. For example, you may still be consulting with management and the sales team about the budget in the morning, but an hour later you can be sparring again with the Leen Bakker/Kwamtum at home managers about gaining better insight into data. for these channels. My duties also include creating business cases for a possible new store, assessing items during the month-end closing and building, integrating and presenting KPIs in Power BI.

Interview Marnix Rosendaal – Head IPB Deutsche Bank the Netherlands

Deutsche Bank is a German global financial institution headquartered in Frankfurt. It is one of the world’s largest banks and operates internationally with operations in more than 70 countries. Deutsche Bank offers a wide range of financial services, including investment banking, asset management, retail banking and private banking. The bank has a long history and is involved in a variety of financial services, including advising businesses and high-net-worth individuals. Like many large banks, Deutsche Bank is subject to strict regulation and plays an important role in global financial markets. What did you study and how did the study help with the job you have now? I did several different studies and quite a detour. My first study was HEAO CE and IM, now known as HBO commercial economics. I then went on to study management and organizational sciences in Tilburg, now called business administration. Remarkably, after that study I started working as a stock trader, despite my non-financial background. Some understanding of math was an advantage for that position. I only did that for a year, as that company went bankrupt within a year. The owner, who had lived through the 1987 stock market crash, speculated daily on another stock market crash. Despite successful transactions for clients and a lucrative partnership with an American company, the company went bankrupt because of its own risky positions. During my time there, I had the opportunity to pursue several studies, including a master’s degree in finance in Tilburg. During my career, I also took leadership courses at INSEAD and most recently at the London Business School, all of which contributed to my development. I held several positions, including private banker and later as head of private banking and branch director in Eindhoven. The whole private banking world and its structure changed significantly during this period. In my early days, all administrative and support functions were organized locally, but this is now all centralized, partly due to automation. At Deutsche Bank Netherlands which now employs about 550 people where it was double that 10 years ago. Automation has led to the disappearance of functions, and the financial sector as a whole has become significantly smaller. When I started, the banking sector was one of the largest sectors in the Netherlands. If you looked at the AEX index and talked about financial companies. At that time, they formed a significant part of the total market capitalization of the AEX. Think of companies like ABN AMRO, ING, AEGON. Tech companies, however, have now added a new emphasis to the composition of the AEX. Is that due to do with the fact that many large companies are setting up in London? Physical bank branches like they used to be, are now gone. You may remember when you could simply walk into any town and find all the major banks located there, complete with full-service options, such as arranging mortgages with a mortgage broker or consulting an advisor for SMEs. That’s all a thing of the past. Most services are now done online, and the few remaining branches are mostly found in larger cities, where you can’t even just walk in without having an appointment. So, the barriers have become higher. The number of employees has decreased significantly, and call centres are on the rise, not only in the Netherlands but also abroad, such as in India. In short, there has been a profound change in the industry that has had a significant impact on employment. How could a student who wants to get into banking, prepare for it? The way it looks now, there have been some changes and some things have remained the same. The basics of a bank and the revenue model, whether financing or saving. A bank like Deutsche is a good example of this. A large international bank that serves it from multinationals to SMEs, to very wealthy individuals and families, and financial solutions for all these audiences. For a student it is attractive to work at an internationally operating bank that serves many customer segments with a great diversity of work and thus career opportunities. So why am I working at Deutsche and not more at a Dutch bank? This is mainly because of its international character and the versatility it offers. When I look back at what I’m doing now and why I like it so much, and why young people should consider it, is because of this audience, which I find particularly interesting. I also left the bank for a while. For six years I had my own business focused on the segment of very wealthy families, the so-called ultra-high net worth individuals (UHNWIs). During my own time as an entrepreneur, I helped these high-net-worth families internationally to consolidate their wealth positions and provide insight through a digital platform. In 2020, that company was sold to an American party. After which I rejoined the bank. The reason why I chose Deutsche Bank and not a Dutch bank stems from the specific needs of this target group. They have sophisticated financial needs because of their global businesses and banking. Whether it is an operating company in a specific country, investing in real estate in New York, or acquiring another company, all of these diverse needs translate into financial solutions. The more international the bank can facilitate these clients, the more attractive you are as a bank to these types of clients. If you look at Deutsche Bank, it has not only private banking but also other services such as investment banking. Does that have an advantage over parties that only offer private banking? That’s a good question and exactly why I started working at Deutsche Bank. This is mainly because of the opportunities available within this bank. In addition to private Bank, there is also an investment bank and a corporate bank. This is different from most Dutch banks. Certain clients need this combined expertise. What makes private banking so interesting is the fact that you always communicate with the

The Rise and Fall of AI Wrappers

In a matter of weeks, artificial intelligence took over the world in a way unseen before. With the launch of ChatGPT by OpenAI in November 2022, everyone suddenly had the capability to utilise the power of AI in their work, but also in their personal life. Be it answering a simple question or providing comprehensive insight into programming, there is an AI application that can help you. Due to the open nature of OpenAI, a new business model was enabled called AI wrappers. AI wrappers, which are also referred to as API wrappers or libraries, essentially build on top of pre-existing AI tools like ChatGPT to provide their service to their client. Because a lot of the heavy lifting is already being done by the engineers of these pre-existing AI tools, it has become incredibly easy to set up a business that leverages the capabilities of AI. As one can expect, it did not take long for these businesses to start popping up. While talking about AI, it’s important to note that AI is a very broad term. When a company uses the term AI, it’s just as vague as someone saying “Oh yeah, I invest.”. When talking about the current hype behind AI, it’s mainly about generative AI which uses large language models, of which ChatGPT is the best example. So what do these AI wrappers actually do? AI wrappers build a user interface for consumers and businesses around the generative AI technology provided by e.g. OpenAI, that is more user-friendly and tailored to specific use cases than ChatGPT itself. Therefore, the business of an AI wrapper is built around the tech provided by another company, hence the name wrapper. An example of an AI wrapper could be a tool that can give you advice on a legal document. Here, the AI wrapper could make it easier to provide the AI with the text of the legal document, but the actual advice would be provided by ChatGPT. With the newfound hype behind the technology of AI, it did not take long for investors to follow the hype with their money. Microsoft was well ahead with their initial investment into OpenAI of $1 Billion in 2019, which they have increased to $13 Billion in total as of writing. With the success of OpenAI, many investors have been looking to invest into AI themselves. While many startups have been grappling with the difficulties of securing funding in the current global economic climate, it seems that investors have been burning holes in their pockets to invest into AI startups. Despite the 48% decline in venture capital investment to $173.9 billion in the first half of 2023, over $40 billion was invested into AI startups. However, the cracks are starting to show. Due to the ease of create an AI wrapper, especially those that only provide little added value, the market has become highly saturated. It has become increasingly more difficult for AI wrappers to generate revenue and cover their expenses. This is mainly caused by the lack of almost any barrier to entry, so much so that many AI wrappers have to deal with free and open-source alternatives. One especially big example of this is the newly unveiled feature of ChatGPT in which anyone is able to create custom versions of ChatGPT tailored to their own specific needs- called GPTs. It becomes immediately clear that these custom versions of ChatGPT are essentially AI wrappers, however, anyone will be able to make them as no coding will be required to make them, and they can even be sold to everyone on the GPT store. While this feature is not live yet, one can already see what impact this will have on AI wrappers. Once customs versions of ChatGPT become available, it will be the final nail in the coffin for many AI wrapper businesses as the last sliver of a barrier to entry has evaporated. While the AI industry as a whole will continue to flourish as the technology continues to develop, it will only be a matter of time until AI wrapper businesses will start to crumble one after the other. With that, the investments in these AI wrappers will turn out to be worthless. That is not to say that there won’t be any successful businesses that can be seen as an AI wrapper, but they will be few and far between. As a result, many investors will have fallen victim to their fear of missing out when the hype around AI started building.

AI and investing: a great success or one big mess?

Disclaimer: This article is for entertainment purposes only and cannot be used for financial advice. Artificial Intelligence is a term that has been gaining considerable traction in recent years and, in its very early days, is already having a big impact on society. Where it is also having a big impact is on the financial sector, and especially on investing. To what extent is Artificial Intelligence changing investing? Advantages First of all, AI allows for more automation. This works through what is known as quantitative trading. This involves creating algorithms that seek out market inefficiencies to take advantage of them. This is done at high speed, allowing for high returns in a short time. Currently, hedge funds in particular make use of this. The use of AI by hedge funds has therefore exploded in recent years. According to a study by Barclay Hedge Fund, more than half of all hedge funds use Artificial Intelligence to achieve higher returns. However, these hedge funds do not achieve more returns directly. The reason is that it is difficult to interpret outcomes of these algorithms. This requires specially trained workers, of which there is currently a shortage. Private investors can also use AI. For instance, websites like ChatGPT are used for investment advice (Investing News Network, 2023). Secondly, Artificial Intelligence enables easier and faster analysis of large data sets. As a result, good investment opportunities are identified faster, allowing for greater returns. Artificial Intelligence also makes it easier to analyse risks. Companies like Deloitte have developed special programmes for this. Next, fraud can be spotted more easily thanks to the advent of Artificial Intelligence. This way, investing remains fairer and investment platforms can more easily guarantee their integrity. For example, if particularly large trades are suddenly made to a bank account or if a disproportionate number of investors go short in a limited period of time, the AI model identifies this as potential fraud. The model then sends a notification to the investment platform and action is taken. Risks Many people are concerned about the impact of AI, including well-known investors including Warren Buffett. He is not optimistic about the future of the technology and calls it a danger to society. He even compares it to the atomic bomb. Despite his concerns, he does invest indirectly in AI. As much as 47% of Berkshire Hathaway consists of Apple shares, and that while Apple is aggressively investing in building products that work with Artificial Intelligence. It also owns $1B worth of Amazon shares (less than 1% of its portfolio). So Warren Buffett sees no future in the technology, but rather in the companies actively implementing it; which is curious to say the least. Another drawback is that the technology can actually be used to commit fraud. The technology can cause identity fraud with the result that investors are hacked. In addition, stock markets can be manipulated. Algorithms created by an AI model contain such a variety of features and functions that traditional algorithms do not have, making it easier to manipulate markets. To prevent this, financial authorities need strict supervision (Ligon, 2023). Another risk is that Artificial Intelligence mainly takes past returns into account. These are no guarantee for the future and can therefore only be used as a tool. Furthermore, AI can lead to discrimination. While this may not be directly related to investing, it is an issue that deserves extra attention. Implementing technology may cause certain people or companies to be excluded, resulting in discrimination. Therefore, it is important not to blindly rely on Artificial Intelligence and use it only as a tool. Conclusion The advent of Artificial Intelligence brings many consequences; not only for society but also for the financial world. It brings many benefits; for instance, large data sets can be more easily analyzed, allowing opportunities to be identified faster. This should ensure higher returns. Unfortunately, this new technology also has drawbacks. For instance, Artificial Intelligence can lead to fraud and can be used to manipulate the market. Furthermore, care must be taken to ensure that it does not lead to discrimination. To ensure that these drawbacks do not take place, it must be strictly supervised by financial authorities. If this happens, the new technology certainly has a future in the world of investing. Furthermore, retail investors should never simply follow financial advice from an AI chat box like ChatGPT.

Alternative investments

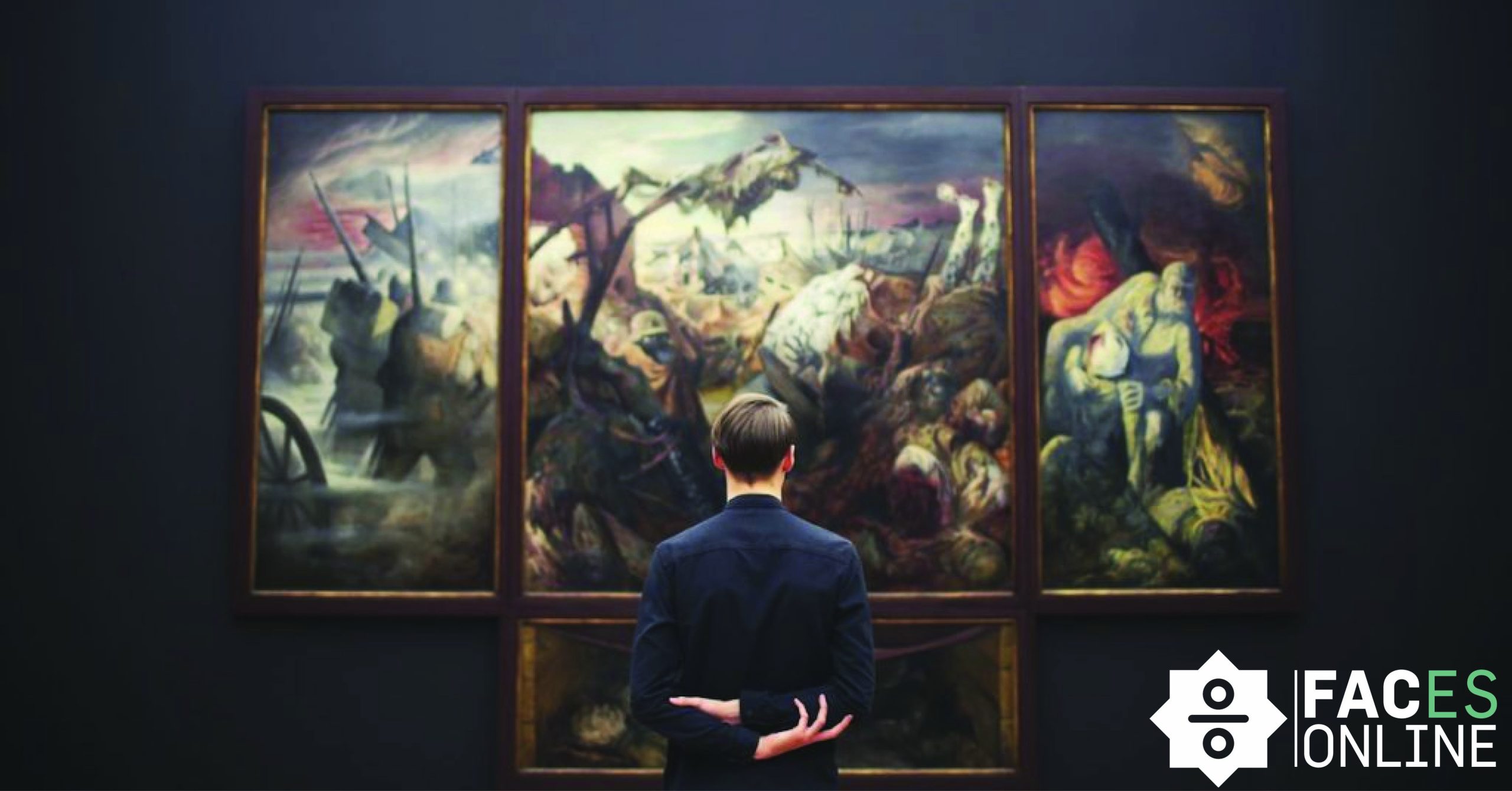

For the Dutch version, click here. Disclaimer: This article does not contain investment advice and aims only to entertain and inform. Traditional investments such as stocks, bonds and real estate are not the only options available to investors. Alternative investments are emerging as an interesting and versatile way to build an investment portfolio. This article will examine different types of alternative investments and discuss their benefits and risks. Classic Cars Many people think that spending a capital on a car is excessive. Especially since cars depreciate in value on average between 10 and 20 percent each year. Still, not every car is a bad investment, as there are plenty of cars that increase in value. For example, we go back to Italy in 1977. A proud owner of the 1962 Ferrari 250 GTO was told by his wife that the car was making too much noise and was forced to sell it, the market value was around $71,000. Meanwhile, the same car is being auctioned for $50,000,000. Another example is the 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe, which was auctioned last year for $149,000,000 (Harshvardhan, A, 2023). The best-known example of cars increasing in value is classic cars. Although experts still debate this, a car is called classic when it is at least 20 years old and of historical importance. These can still be divided into vintage and antique cars. Vintage refers to cars made between 1919 and 1930. Antique cars were made just before 1919, during the so-called “Brass era,” which refers to the large amount of metal used to make these cars. To give just one example, vintage cars have increased 185% over the past decade ( Piovaccari, G & Za, V, 2023). Still, determining the market price of a car seems difficult at first. Fortunately, Hagerty, an insurer in classic cars, has the solution to this. The firm tracks the value of classic cars in a clear guide. Each model is given a figure based on its condition. Nevertheless, there is a lot of uncertainty involved in buying a classic car. Although Hagerty’s gives a good indication, there is no guarantee that the guide is completely accurate. In addition, unlike stocks or bonds, a car is physical. Therefore, a garage, for example, must be considered, which entails additional costs, and insurance for classic cars is quite expensive. In addition, this makes the investment a lot less liquid, since it remains to be seen how quickly a buyer can be found. Also, a relatively large capital is needed to profit from possible price increases. However, there is now the possibility of investing in classic cars without physically buying them. There are several funds where investors can invest in classic cars. An example is Azimut, however, investors must put in a minimum of $140,000. “Where should I start if I want to invest in art?” Art In addition, investing in art is an interesting option that is becoming increasingly popular. In general, art is seen as a fairly safe investment, as its value has gradually increased over the past few decades. The chart below shows that “Contemporary Art” is rising at an average annual rate of 14%, which is considerably higher than the S&P 500. “Contemporary Art” includes works of art where the artist is still alive. This positive growth is also noticeable among wealth managers, where only 55% in 2014 thought art should be part of an investment portfolio, this percentage to 78% (Deloitte, nd). Nevertheless, art makes up only 2% of all investment portfolios. Thus, there is still plenty of room for growth. The most logical reason that art performs above average is because of scarcity This is also the main reason why the original is (and always remains) worth more than fakes. This also explains why a certificate of authenticity often accompanies the original of famous paintings. Furthermore, there are also other factors that determine the value of a painting. For example, the quality of the canvas is essential and an artist’s signature on the artwork further increases the value. Still, of course, the question remains: where should I start if I want to invest in art? As Warren Buffett always says, “Invest only in what you understand.” Try to gather as much information as possible about the art world, read books and do online research. Furthermore, it is wise to visit museums and expand your network in this world as much as possible and view it as a long-term investment (Atelier, 2022). One of the drawbacks, however, is that works of art, like cars, are not liquid. Should a work of art have increased in value and you, as an investor, want to profit from this, it remains to be seen whether a buyer can be found in the short term. Fortunately, you can also invest in art through funds, such as Masterwork. This does not require a minimum deposit. Another disadvantage is that most of the return comes from the relatively expensive works of art, but these are traded through large auction houses. The problem with this is that the transaction costs are comparatively high and therefore the returns are generally low. Watches Investing in watches can also be an interesting option for people interested in collectibles and valuable items. Watches can increase in value over time, especially if they are produced by reputable watch brands in a limited quantity. When investing in watches, it is important to pay attention to the quality of the watch, its condition and the demand for the brand and model. Material of the watch, the completeness of the set (original box and papers) and the condition of the watch are also important. Some collectors prefer vintage watches, which in many cases are rarer and thus can fetch higher prices. It is also important to invest in watches released by reputable brands, such as Rolex, Omega, Patek Philippe and Audemars Piguet. These brands have a long history of producing quality watches and have built a strong reputation over

Working at Deloitte

About me I am Joost van Kommer and I have been working at Deloitte since September 2019. At the time, I started as a working student at the end of my bachelor. I am currently 24 years old and live in Tilburg. I followed the bachelor Business Economics and master Accountancy at the university. Currently, I am following the post-master Accountancy to Chartered Accountant at Tilburg University. My introduction to Deloitte I first came into contact with Deloitte during the Economic Business Weeks Tilburg. Here, a day was organized to get acquainted with all Big 4 firms. During this day I had the opportunity to talk to all offices and get an idea of the work and the mutual atmosphere. A golf workshop was followed by a drink where I quickly ended up at a table at Deloitte. There were colleagues from different cities present so it was also possible to get an idea of the various offices. It turned out to be a very successful event, which immediately gave me a good feeling about the people of Deloitte. This feeling was mutual, because after the party I was invited to visit the Eindhoven office. The click with the other colleagues was also good, so my choice for Deloitte was quickly made! My experiences at Deloitte Since September 2019, I have been working at Deloitte as a working student and thesis intern, among other things. As a working student, you get the chance to work as a full team member on an audit. The team gives you a lot of room for guidance and your own development. My very first client turned out to be a first year audit, which can rightly be called a ‘baptism of fire’. I experienced it as very instructive to learn how an audit is planned from the very beginning. The work-study position offered a great opportunity to get a taste of the work and to get to know colleagues in my teams. This made me feel completely at home in the department during my thesis internship. During the writing of my thesis, I also had the opportunity to work for different clients. The focus during this period is also on getting to know the many colleagues and discovering the opportunities that Deloitte offers. “At Deloitte, there is room to spend part of your time on social projects”. At any point in your career at Deloitte, you are fully included in the group. As a working student I went on a skiing trip to Austria and during my thesis internship I was taken to the Private Day at the Efteling amusement park. Next week a festival will be organized at Thuishaven and on behalf of the Eindhoven office we will participate in an international indoor football tournament in Prague. Enough opportunities to relax! A lot is possible within Deloitte. During your introduction program you will be made aware of all the initiatives within the organization. For example, there is room to spend part of your time on social projects (Deloitte Impact Foundation) and there are sports programs and apps available where you can even save for free goodies! Deloitte is a large organization and you can really notice that. Besides the drinks and parties there are also a lot of opportunities at work. You can indicate to your coach which clients you prefer. Would you like to take a look at a listed company? Or would you like to see a client in a certain sector? There is always more possible than you think! Even if you want to develop yourself outside of audit, there is room for this. You can take on a role where you specialize in, for example, IT, data analysis, sustainability or culture so you can help your colleagues with these topics in their work. There is a lot of knowledge and expertise available at Deloitte that you can always call upon! What I want to give to students As an accountant, the nature of the work will not easily differ between the various offices. Therefore it is mainly good to get an idea of the atmosphere at an office. Do you already know someone who is doing an internship or works at an office? Ask if you can join them or drop by the office! Often career events are organized in which the big accounting firms participate. It is always a good idea to make use of these events as they also give you the opportunity to get to know each other in a more informal setting. Often recruiters or colleagues will be able to tell you a lot of great stories that you might not see on LinkedIn or their own website. Make sure you use these moments! Also take a look at the LinkedIn feeds of the offices to see what they are doing. You can get a good idea of how they respond to social issues or new laws and regulations. This can also help you to see if the organization suits you! Deloitte is an incredibly nice employer that I will recommend to every graduate accountant. Are you excited too? Or would you like to get acquainted to see what Deloitte has to offer? Don’t hesitate to send me a message via LinkedIn (https://www.linkedin.com/in/joost-van-kommer/) or to contact our recruiter Emily Ng (+31 6 36425847).