On May 2, the fifth edition of the Investment Night took place. During this interactive evening, various professional investors came to the Studio of Theaters Tilburg to discuss and share their investing strategies with the students from Tilburg University.

The evening

The Investment Night, led by chairman of the evening, Janneke Willemse, hosted a panel of three distinguished speakers who discussed several topics about how to invest by yourself and how to deal with risk. The panel consisted of Roel Gooskens (independent stock analyst), Jean-Paul van Oudheusden (COO of IEX Group) and Hans Betlem (CIO of IBS Capital Allies). The speakers came up with presentations about value investing, portfolio management and identifying risk. Besides the presentations, there was a quiz and the victor won ‘The Little Book That Still Beats the Market’ of Joel Greenblatt.

As the event is built upon the guest speakers, the committee selected an interesting mix of professionals that have a strong view about investing and the stock market. As a result, the speakers exchanged many surprising insights and had very interesting discussions. I would like to introduce the guest speakers of the evening.

“Worst case scenarios can be much worse in the future!”

Janneke Willemse

As the chairman of the evening, Janneke Willemse kicked off the evening with a short introduction of the speakers. She led the Q&As, discussions and the quiz.

Janneke Willemse is a presenter, journalist and a keen investor. She is stock markets commentator for financial news channel RTL Z, presents Geldzaken on 7 Ditches TV and frequently moderates seminars and debates. She presented broadcast WNL op Zondag on NPO 1 and was nominated for the Upcoming Talent Award at Gouden Televizier-Ring in 2014. Janneke started the successful website BlondjesBeleggenBeter.nl, a nod to the many studies showing that women invest better than men. Her returns beat benchmark AEX in 2014, 2015 and 2016.

Roel Gooskens

Roel Gooskens showed the audience his four-step approach of investing. He emphasized value investing and the enemies of the private investor. He came up with very strong arguments and recommendations. Furthermore, he was very open about his personal preferences of investments and shared a lot of his experience.

Roel Gooskens has a degree in Business Economics in Tilburg. From 1984 to 1988, he worked as asset manager at Robeco. Thereafter, he worked at Van Meer James Capel (became HSBC) for thirteen years. His functions were subsequently analyst, Head Research of the Netherlands and Head Smaller Companies Research Europe. He even became the Managing Director of HSBC Nederland. From 2001 to 2010, he worked at Asset Management Franklin Mutual (part of Franklin Temptation) as general analyst/stockpicker. Furthermore, Roel Gooskens was representative for his clients in lawsuits against DSM, HunterDouglas and Unilever.

Roel Gooskens in the financial world is well-known as a critical stock analyst. He was one of the first who noticed and warned for Ahold’s troubles. Lately his name was mentioned in connection with Value8. Value8 is the investment company of Peter Paul de Vries, former CEO of the VEB. Furthermore, he wrote several controversial analyses for Follow the Money.

Jean-Paul van Oudheusden

Jean-Paul emphasized the madness of the day and showed the audience what is important to watch when you want to invest. He explained that we have to be our own portfolio manager and put things in perspective. As an example, he compared it with a football formation: savings as the keeper, bonds are the defense, stocks and ETFs in the midfield and turbos and options as the strikers.

Jean-Paul van Oudheusden is an investor in heart and soul. After his Master in Econometrics at Erasmus University in Rotterdam he started his career as a management trainee at ABN AMRO Asset Management during the ‘camping hausse’ of 1997. From 2000 onwards he built a reputation as a specialist in the Dutch banking sector. He worked in the dealing rooms of ABN AMRO and RBS in London and Amsterdam for twelve years and stood at the cradle of the investment product turbo. After three years at BinckBank he is now one of the directors at the listed media company IEX to lead the company into financial services.

Hans Betlem

Hans Betlem explained that concerning to risk, we are all future blind. It is hard to identify risk and he showed us the problem of induction from different perspectives in relationship with the trinity of risk. Watch out for people who say ‘never’ and worst case scenarios can be much worse in the future!

From 1985 till 2012 Hans Betlem worked at Merrill Lynch in Amsterdam where he was responsible for managing client portfolios. In 2012 Hans Betlem and four partners purchased the small Amsterdam-based asset manager IBS Vermogensbeheer. Since then they have successfully transformed IBS into a boutique specialized in asset management, corporate advisory, alternative investments, fiduciary management and fund management. Along the way, they changed the name of their company into IBS Capital Allies. Hans Betlem is the Chief Investment Officer at IBS. Hans also spoke on the third edition (two years ago) of the Investment Night.

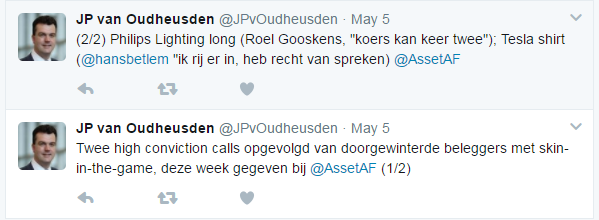

To summarize, it was a fun evening including a lot of interesting and surprising insights. Moreover, this edition of Investment Night had a record number of registrations (over 200) and I believe it was very successful. Both the speakers and guests were very enthusiastic. Afterwards, Jean-Paul van Oudheusden tweeted about some advice he followed up from the speakers that evening:

On behalf of Asset | Accounting & Finance, we would like to thank the speakers, the audience and our partners for this amazing night. This would not be a success without the committee and our coordinator, so I want to thank Melissa Spork, Manon Frissen, Krijn van den Broek, Walter Verdiesen and Loran Matulessy for everything they have done. I am very proud that the Investment Night 2017 was a great success. We are looking forward to the next edition!