1. Introduction

Obviously, Brexit could have a variety of non-client related effects for Dutch auditors. For instance, the auditor labor market in the United Kingdom (hereafter: UK) might be affected significantly, thereby changing supply of audit labor in the Netherlands. Or after Brexit, UK audit firms might not be able to operate in the Netherlands and vice versa (article 3A of the Audit Directive). This might affect competition in the Dutch audit market. Also, some audit firms could be jointly owned with UK owners. Dependent on the type of arrangement between the EU and the UK these ownership structures need to change. As these non-client engagements effects are broad, difficult to quantify, and depend on the terms under which the UK leaves the EU, I use the framework of an audit engagement to discuss some effects of Brexit for Dutch auditors. In paragraph 2.1, I start with a discussion the potential overall magnitude of Brexit. In paragraph 2.2 I turn to Brexit related audit risks. Paragraph 3 concludes.

2. Brexit and audit engagements

2.1 What is the potential overall magnitude of Brexit?

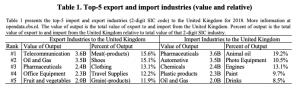

When assessing the potential audit risks the auditor needs to understand the client and its environment (ISA 315 para 11). To understand the potential effect of Brexit, I first turn to a broader understanding of the total potential magnitude of Brexit on Dutch firms. At first glance, the scope of Brexit effects appears relatively clear. The UK is (after Germany and Belgium) the third biggest trade partner of the Netherlands. The Netherlands exports 40 billion euros to the UK and imports 20 billion euros (CBS 2018).(1) This is 8.0% of total export and 3.4% of total import. It goes without saying that to a varying degree, Brexit likely affects many firms commercially and operationally. Table 1 presents a top-5 of industries that have the most export to and import from the UK in value and percent of output. From table 1 can be concluded that industries affected in terms of value are different industries then the firms affected in relative terms. Moreover, the relative impact to industries is more homogenous then the value impact as indicated by the coefficient of variation for all the industries (not tabulated). This implies that to a certain extent each industry is affected. Also, firms that do not export to or import from the UK could be affected. For instance, a significant drop in export could lead to more domestic competition and accompanying margin pressures. To sum up, the product market for certain industries in the Netherlands will be severely affected by Brexit.

“The scope to which Brexit can affect financial markets in a direct and indirect way is currently not clear.”

However, the interconnectedness of the UK and the Netherlands is broader than product markets.(2) Firstly, services could be particularly affected by a no-deal Brexit. For instance, airlines and the hospitality sector where margins are small and volume drives profits (i.e. tight cash flow businesses) are directly threatened in both the short and long-term. Secondly, less is known about the impact of Brexit on financial markets. I give some examples. In the top-100 of investments of ABP (the Dutch pension fund for Civil Servants) the fourth largest investment are fixed-income investments in the UK, the second biggest currency risk is the British pound.(3) It is not clear what the effect of Brexit will be for pension funds. Similar exposures are expected with banks and insurance companies. Another example. London is the global leading financial center for over-the-counter derivatives.(4) OTC transactions (such as credit-default swaps, interest-rate swaps and currency-swaps) with a UK counterpart are probably affected by Brexit. This could be due to a lower creditworthiness of the UK counterpart or the value of UK-linked collateral. However, the scope is much larger than one initially would expect. As a vast majority of OTC contracts are governed by English law, resolution is subject to English courts. It is likely that even OTC contracts without a UK counterpart is therefore affected by Brexit. The big issue is that OTC contracts vary significantly, and it is difficult to renegotiate these contracts as the terms of the Brexit agreement, if any, is not clear. Taken together, the scope to which Brexit can affect financial markets in a direct and indirect way and it is currently not clear.

Table 1 presents the top-5 import and export industries (2-digit SIC code) to the United Kingdom for 2018. More information at opendata.cbs.nl. The value of output is the total value of export to and import from the United Kingdom. Percent of output is the total value of export to and import from the United Kingdom relative to total value of that 2-digit SIC industry.

2.2 Brexit-related audit risks

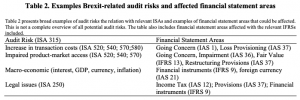

Auditing services are highly regulated to ensure a non-zero audit effort by auditors.(5) Therefore it obvious to analyse potential effects for auditors based on this regulation. ISA 315 requires auditors to understand the business of the audit client.(6) A client business risk reflects the possibility that an organization will experience adverse outcomes as a result of economic conditions, events, circumstances or management action/inaction (Knechel and Salterio, pp. 67).(7) Business risks are important to auditors as they inform the auditor on the effectiveness of the client risk management and the impact on financial statements. Brexit to a varying degree likely affects the economic, regulatory and business environment of audit clients.(8) Auditors need to assess whether clients have appropriately assessed, concluded and, disclosed relevant risks and uncertainties on Brexit. In table 2, I provide some examples of Brexit-related audit risks that are subsequently discussed below.

“I believe it is key for auditors and audit firms to develop a consistent audit approach in response to Brexit.”

I believe the first order economic effects of Brexit to firms is an increase in transaction costs and impaired market access. Firstly, a clear and direct impact of Brexit on import and export activity is an increase in transaction cost. Increases in tariffs, duties and a higher administrative burden are expected. In turn this will affect the fulfillment of delivery contracts. This might lead to onerous contracts, particularly in a no-deal scenario. To mitigate short-term impacts, the UK government has decided that during 12 months after a hard Brexit certain product would be tariff free.(9) Secondly, in the more long-run Brexit will result in impaired market access to the UK. The magnitude of this impaired access will vary dependent on the terms and agreements under which the UK will leave the European Union. Thirdly, as a result of Brexit the macro economy from both the UK and the Netherlands could be affected resulting in interest, currency, inflation and real GDP effects.

Increased transaction cost, impaired market access, and macro-economic effects result in management assessments having a greater Brexit-related component throughout financial statements areas. Brexit-related risk factors in going concern (IAS 1), impairment (IAS 36, IFRS 9), fair value assessments (IFRS 9, IFRS 13, IAS 40), equity accounted investments, deferred tax assets (IAS 12) and the ability to fulfill current contract requirements primarily impact projected cash flows. This cash flow impact can have different forms, such as (but not limited to): increased transaction cost, loss of revenue potential, currency effects, and tax implications of cash flow issues.

Auditors will need to carefully assess management’s evidence supporting cash flow assumptions. Management may resist the disclosure of the assumptions on the basis that they have planned and mitigated the risk, and that such disclosures are commercially sensitive. However, in accounting standards (e.g. IAS 36) there is no commercial sensitivity override for disclosures and auditors will need to be prepared to challenge management on the adequacy of reporting here, and in the reporting of risks facing the business and business prospects more generally.

A greater Brexit component with more uncertainty in assertions can also impair the quality of management information pertaining the UK, which in turn, can affect the quality of management decision making as a response to risk. Moreover, a greater Brexit component in assertions affect the reliability of data and potentially impairs the suitability of analytical procedures carried out by the auditor and the ability to predict results (ISA 520).(10)

“In my view, it is this professional judgment what makes being a professional auditor such an interesting job.”

Increased legal issues might be problem that potentially have a broad scope potentially encompassing a variety of regulations including but not limited to tax law, product law, contract law, and company law. I believe this area might have big implications that are more difficult to anticipate by the auditor than the other audit risks mentioned in table 2. I already mentioned OTC derivative issues in paragraph 2.1. Another example is the legality of dividend payments. In principle this is an issue for management, but auditors should be aware of it. There is a risk that unlawful dividends might be paid if: the directors fail to take account of losses between the year-end and payment date or fail in their fiduciary duty to consider whether the dividend payment might threaten future solvency (actio pauliana).

Brexit will also affect trade-based fiscal regulation. Companies transporting products and services to and from facilities in different EU countries need to pay taxes in these countries. Due corrections to intercompany transactions, products are often double taxed by different tax authorities. However, companies can currently completely avoid this double taxation in the EU through the EU arbitration convention. After the UK leaves the EU, the UK would no longer be party to EU fiscal legislation. There is a risk of increased tax liabilities particularly in the event of a no-deal Brexit as some EU-related tax reliefs may fall away.

Table 2 presents broad examples of audit risks the relation with relevant ISAs and examples of financial statement areas that could be affected. This is not a complete overview of all potential audit risks. The table also includes financial statement areas affected with the relevant IFRSs included.

3. Conclusion

The analyses above shows that the potential overall magnitude of Brexit is not completely clear. I believe the impact on the product market is relatively straightforward. However, the impact on the financial market is less clear. Brexit effects on OTC derivatives are an example. Turning to Brexit related audit risks reveals an overall increase of a Brexit component in the assessment of future cash flows. Potential legal issues, however, are potentially broad and less clear.

Therefore, the emphasis for auditors should be on exercising professional judgment. However, I believe it is key for auditors and audit firms to develop a consistent audit approach in response to Brexit. Without being exhaustive this approach could include: a common set of criteria to determine the accuracy of Brexit disclosures, what minimum information should management provide concerning Brexit assessments, auditor independence concerns when clients need auditor assistance on Brexit. In addition, ISQC1 and ISA 220 requires audit firms to consider Brexit considerations when selecting files for quality reviews. Enforcers (ESMA and AFM) made Brexit-disclosures an enforcement priority. They state that firms should provide enough transparency on its impact on their exposures and activities as well as risks and sources of estimation uncertainty and the way these are managed based on the specific circumstances of individual issuers.

Finally, a clear limitation of this article is that is by no means a comprehensive overview of the effect of Brexit on Dutch auditors. I decided the highlight certain issues, other auditors might highlight other issues. In my view, it is this professional judgment what makes being a professional auditor such an interesting job.

Literature

- Beg, I. and F. Mushovel (2016) the economic impact of Brexit: jobs, growth and public finances.

- ESMA European common enforcement priorities for 2018 financial reports

- EU Audit Directive.

- ISA 315 Identifying and assessing the risk of material misstatements through understanding the entity and environment.

- ICAEW Auditing if there’s no Brexit deal (June 2019).

- Knechel, R. and S. Salterio (2017) Auditing, Assurance and Risk – Fourth Edition.

Footnotes

- https://www.rvo.nl/onderwerpen/internationaal-ondernemen/landenoverzicht/verenigd-koninkrijk/handel-nederland-verenigd-koninkrijkA quick textual analysis on UK annual reports of listed firms for the year 2017 and 2018 reveals that on average the word Brexit is used 5 times with a standard deviation of 4 and 96% of all firms mention Brexit. This could be an indication of the magnitude of Brexit.

- The labor market might be affected. About 50,000 UK residents live and work in the Netherlands. In turn, about 100,000 Dutch residents live and work in the UK. This is about 1% of the Dutch labor market. I expect this impact to be small.

- https://www.abp.nl/images/top-100-largest-investments-of-abp.pdf and https://www.abp.nl/images/ABP-jaarverslag.pdf

- http://www.allenovery.com/SiteCollectionDocuments/Derivatives_Brexit_Bulletin.pdf

- Effectively this prevents auditors from behaving like an insurance company by collecting audit fees and pay-out in case of claimed damages.

- The objective of the auditor is to identify and assess the risks of material misstatement, whether due to fraud or error, at the financial statement and assertion levels, through understanding the entity and its environment, including the entity’s internal control, thereby providing a basis for designing and implementing responses to the assessed risks of material misstatement (ISA 315 para 3).

- A business risk is (ISA 315 para 4b): “A risk resulting from significant conditions, events, circumstances, actions or inactions that could adversely affect an entity’s ability to achieve its objectives and execute its strategies, or from the setting of inappropriate objectives and strategies.”

- In this short analysis I abstain from potential fraud risk effects of Brexit. I also do not focus on specific group audit issues in the context of ISA 600 and on potential effects of auditor reporting (ISA 700). Finally, a no-deal Brexit could have a variety of effects on financial statements. For instance, UK firms will apply UK-adopted IFRSs. In a group audit this might imply auditing using a different set of applicable accounting standards. For cross-listing firms with listings in the UK and the EU this leads to preparing two sets of accounting standards. Also certain filings exemptions in the UK might not be fully applicable with a parent outside the UK. This article does not structurally consider the potential effects of a no-deal Brexit.

- http://www.allenovery.com/Brexit-Law/Documents/Tariffs_paper.pdf

- The decision about which audit procedures to use to achieve an audit objective is based on the auditor’s judgment about the expected effectiveness and efficiency of the available audit procedures in reducing the assessed risk of material misstatement at the assertion level to an acceptably low level (ISA 520.10).