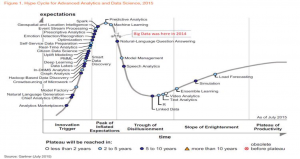

Last summer, Gartner brought the term ‘big data’ towards its final resting place as a concept, a data-designation, marketing term and ‘buzz word’. The year 2015 is thus a sad year for all enthusiasts, gurus and marketers of big data. In 2014, big data as a topic was already over its ‘hype cycle’ and the expectation was that big data would, step by step, move towards the ‘Plateau of Productivity’. That is, the phase in which newer technologies surpass the hype for good and manifest themselves very positively. The business case has been proven, the technologies are developed further and everything falls into place. According to Gartner, big data has missed that chance. In the summer of 2015, big data has been declared ‘obsolete’.. End of story, end-of-the-line, over and out.

Is it really that dramatic? Has big data become nothing more than a ‘buzz word’? I cannot imagine that this is the case. But what I have seen is that big data, at a certain point, could ‘solve’ more or less every world problem. No more famine on this planet, thanks to big data! Polar bears saved, due to big data! The Dutch football team finally becomes the world champion, because of big data!

Make no mistake, there are numerous sectors in which big data brought about breakthroughs, and still does. I mention two extremes here: health care and marketing.

In health care IBM Watson (an incredibly powerful super computer capable of analyzing huge big data sets) plays an important part in researching for example cancer. In the marketing industry big data is being used to develop customer profiles and to influence consumer behavior so companies can ultimately stimulate spending. It tracks everyone who is online. If you check out Marktplaats.nl (a Dutch version of eBay/Craigslist) for a nice little second-hand cart, chances are you’ll ‘accidently’ encounter advertisements for many more of those cute, highly similar carts. Your online profile has been created and is being monitored, updated and influenced on a continuous basis. For yourself, and pretty much half of the globe. Here you go: big data!

Do you wonder what big data actually really is? Then have a look at the image below, which neatly summarizes it. It’s all about four dimensions. There must be a high volume of data (so a lot of data collected), variety (the number of sources of data) plays an important role, but also velocity (the speed at which data can be generated and analyzed) and veracity (degree of reliability of the data) determine the playing field.

Just to be clear, big data is not equivalent to data analysis. We already utilize data analysis for connecting and analyzing transaction streams of, for example, purchasing process (procurement) combined with the sales process. These are relatively simple datasets (with sometimes very large volumes), that need not necessarily satisfy the four dimensions of big data.

At Coney for example, the firm I am (not entirely by chance) associated with, we already audit by deploying data analysis and process mining, but we absolutely can’t speak of integration of big data in the auditing practice (yet).

Now that the four dimensions are noted, and I named two sectors in which big data acquired its place in many aspects, the key question of this column is: How many applications of big data are currently integrated in the legal audit of a financial statement from an organization of public interest? With respect to the ‘volume-criterion’, I might as well raise the bar right away. Because I daresay that this is, as of now, very limited to nothing. Do I see the possibilities of using big data in auditing for myself? Absolutely!

Checking and assessing debtors? Soon you will be able to do that with a real-time connection to the credit management agents that track and rate the payment behavior of businesses. A sophisticated algorithm tests the management of debtors of your client and predicts whether debtors are able to pay or not. This happens in split-seconds. You won’t assess single clients anymore, but entire groups of clients simultaneously.

Analyzing, among others, profit margins by verifying the correct selling prices? Imagine that you’ll work as an accountant at the Dutch web shop Bol.com. Smart auditing robots developed by your accountancy firm make sure that, ‘from a distance’, the right profit margins are set by constantly looking up the selling prices of Bol.com (external source) and comparing these in split-seconds with the justified selling price in the database. Naturally this also happens at the purchasing side.

Do I see the prerequisites under which big data can have a part in the auditing for me? This is not an easy playing field! Satisfying strict privacy regulations, guaranteeing the quality of big data and to obtain relevant, almost real-time data for the benefit of the auditing team… These are just some major bumps in the road.

Long live big data! Because me being an optimist, I foresee we can overcome these bumps in the next five or ten years to come. In fact, I think that Gartner is completely wrong. I think that applying big data will turn the world of accountancy on its head, because of the following reasons:

1. In the upcoming 10 years we are going to see a move from ad-hoc auditing (on average three to six months after the balance sheet date, cough cough…) to continuous auditing. Big data (think here of the velocity criterion) follows perfectly on this and becomes the ‘smart data engine’ of the auditing-check.

2. Furthermore I feel supported by a recent article of fellow author Lucas Hoogduin, titled ‘Big Data as Complementary Audit Evidence’. In this article it is explained, in a structured and particularly constructive manner, how big data can support auditing qualitatively. I have read the article twice, and I felt huge recognition in it. But still there is a lot of work to do and I count on the future generation of accountants to contribute substantially to this. Long live big data!