Jolien Sap is an Analyst in the Corporate Finance team at Van Oers. She will take you through her (study) career and the developments she has gone through so far within Van Oers. Study After obtaining my vwo-gymnasium diploma, I started as a student of the bachelor in Business Economics. After obtaining my Bachelor’s degree, I successfully obtained the Master Accountancy and the Master Finance. In 2023, I received my degree for these. I look back on an instructive period in which I was ready to put my experience into practice! The right match During my study, I worked at the audit department of Van Oers in 2021, I discovered that audit was not quite the right place for me. Still, I looked back positively on the period I had worked at Van Oers. This was partly because of the fun culture and committed colleagues. I was therefore wondering if I could do better in another department. So I started talking to other departments. Van Oers was also actively involved in this process. They really look at where your talents are used in the best way. That is great. While I was taking the master’s in Finance, I had regular contact with Joost Akkermans from the Corporate Finance department. While completing this master, we started talking again for a position within their team. There I have been working full-time as an Analyst since September 2023. Lots of variety There are three disciplines under the Corporate Finance department: M&A, Due Diligence and Debt & Restructuring. As a starter, I entered the department as a general analyst. This means that I help with projects in all departments to find out which discipline suits me best. Because of this, my work is very diverse. Here are some of the projects: Helped D&R with financing models. Writing financing Memorandum Attending client meetings Setting up data books for financial analysis and reporting Valuation of organizations Writing an information memorandum for M&A Coordinating a book examination By working in all disciplines, I really discover what I am good at and where my preferences lie. I really feel that I get all the space I need to keep developing myself! Room for growth and development Van Oers is a training company, something that really appealed to me as a starter. Within Van Oers you get the opportunity to learn and develop quickly. From day one, you are actively involved in projects and are given your own responsibilities and go along to customer meetings right away. This way you quickly develop the hard and soft skills needed for the job. Because Van Oers consists of many different departments, there is a lot of knowledge available. For example, if you have a tax or legal question, there is always someone within the company who can help you quickly. These are factors that help us achieve the best result for our customer. Of course, Van Oers is also a very pleasant company, where we love parties and celebrating successes. Both large and small. From student life to work life The step from student life to work life took some getting used to. During college, you are used to arranging your own time more, such as sports and studying when you want. When you start working full-time you automatically start adjusting your rhythm more. Now that I’m used to it, I like having more stability, and not having any obligations after working hours. Then I make time for my hobbies, sports and friends. The nice thing about working at Van Oers is that hybrid working is possible. Depending on team and client agreements, of course! Tips for students I can recommend everyone to work during their studies. I found out that working in an audit department did not suit me at all and that I had to look for something else. Gaining relevant work experience during your studies helps you to find out what does or does not suit you. It also helped me to participate in events organized by the study association. This enables you to come into contact with companies and to get an idea of what you like and what kind of employer suits you. Would you also like to realize your ambitions at Van Oers? Feel free to contact one of our recruiters Wendy and Daniëla, or send an email to werken@vanoers.nl. Also take a look at our updated website: https://bit.ly/3vFVMWV]

Interview with Gerald Cartigny & Patrick den Besten – Co-CEO & CRO of Goldman Sachs Asset Management B.V.

Goldman Sachs Asset Management (GSAM) B.V. is the Dutch asset management arm of Goldman Sachs. GSAM offers various investment strategies to investors, with a focus on equities, fixed income, quantitative solutions, alternative investments and multi-asset solutions. Two of our alumni were asked 10 questions in this interview. 1) How did you go through your studies and what was the transition like from being a student to your first job? Patrick den Besten: ”I started studying economics in 1992, and eventually graduated in 1997. I graduated in Money, Credit & Banking. During my studies, I worked at Staalbankiers, where I was responsible, together with their macroeconomic office, for creating a macroeconomic vision. Equities and investing have always been interesting to me. Early in my career, I transitioned smoothly from working at Staalbankiers to the Strategy/Asset Allocation team at Aegon Asset Management. At the time, this was one of the partners of the university. Just before the end of the dotcom bubble (March 2000, ed.), I moved to the Equity team at ING Investment Management. The study in Tilburg was very practical and for me, it helped to create a smooth transition to the workplace.” Gerald Cartigny: ”I started at Tilburg University in 1984, and in 1989 I graduated in business economics with a focus on corporate finance. I ended up taking five years to complete the degree, due to a board year at the sports organization Pendragon. At the time, one of my professors suggested me to do an internship; that’s how I ended up at the NMB (Nederlandse Middenstands Bank, ed.), where I researched the topic of Eurobonds. This was a new phenomenon at the time, and the NMB commissioned me to research this by surveying all the important investors in the Netherlands. This turned out to be a great advantage because when I finished at NMB, three of the parties I visited offered me a job spontaneously. By coincidence, with this internship and job offers, I ended up in the investment world. At the time, I chose Nationale Nederlanden, already a big investor during that period. I started in the department that manages the portfolio of the insurer. So, for me, it was also a very smooth transition.” 2) What are the most important lessons, skills and habits that you picked up during college that you still benefit from? Gerald Cartigny: “The board year at Pendragon was very helpful, the dynamics there ensured that you had to be able to communicate with everyone, tune in and take action. Later in my career I worked in the US for 3 years, which brought a lot of enrichment. The activities alongside my studies were important and I learned a lot because of it.” Patrick den Besten: “What I learned the most from was my internship at the Staalbankiers. There I was able to engage in discussions with the people who were in control. I was in the dealing room, which was quite small. But what I learned in theory, I tried to put into practice, which was very beneficial. Above all, engage a lot in conversation with fellow students, and be involved in different things. I got a lot of pleasure out of doing projects with other students and engaging in discussions with my professors. Try to seek other perspectives: don’t take things for granted. Engage in discussions, even during your first job. I think that’s very important to make sure you become very well-rounded, which requires you to do more than just exams and studying.” Gerald Cartigny: “One more addition, I learned the following during my board year: if you want to do something, you have to be proactive. That applies to your entire career. Nothing comes to you, there are lots of opportunities for all students, but you need engage actively. Take advantage of these opportunities and be curious; that is also something we (GSAM, ed.) look out for in the people we hire.” 3) What does the corporate culture look like within GSAM? Patrick den Besten: “For me, the following aspects are important: First of all, expertise; Don’t sit around, show initiative; And drive, we want to see energy. I think this is important within every company. But for large companies, leaders in their market segment, these are the people they need to make sure they stay the best.” Gerald Cartigny: “To illustrate: Goldman Sachs is a global company with about 45,000 employees, we hire about 3,000 graduates every year. These hires come from a selection of about a million letters we get. In those letters, almost everyone qualifies based on studies and secondary activities. However, in order to hire those 3,000 individuals, for one position we sometimes interview 15 people. We check if the candidates show that they are motivated, but also that they enjoy working with us. And that’s also what Patrick says: the “eagerness” has to be really evident because the difference on paper keeps getting smaller and smaller between students. When you are applying, you have to think about your presentation and preparation, but you also need to know what you exactly want. If you don’t know what you want, then it’s pretty hard to get concrete with a company.” 4) What does the Chief Risk Officer do on a day-to-day basis? Patrick den Besten: “As an asset manager, you manage risk for two main categories: operational and financial risks. Financial risks arise as a result of our investments in equities, derivatives and bonds in the financial markets. Thus, I work daily with the portfolio management team to evaluate the state of the portfolios. During unique events, such as geopolitical developments, we work even closer together. On the other hand, there are operational risks. We manage clients’ money, including large institutional clients and individuals who invest in funds. As a risk management team, we make sure that the funds we manage are invested according to the agreements made with the clients or as stipulated in the prospectus for a specific fund. This brings

Working at – Wesselman

Who are you and what is your background? “I’m Aniek de Bekker (22 years old) and – if you’re looking for me – I can be found on the hockey field or the padel court. At the latter you can also find me with my colleagues by the way,” she says with a laugh. “When I’m not playing sports, I focus on my Business Economics studies at Tilburg University or my work as an Assistant Accountant at Wesselman.” You’ve been working here for several years; how did you end up here? “In year three of the Bachelor of Business Economics, I was presented with a choice: go abroad for six months, take a minor or do an internship within the field. I wanted to apply the theory I learned at school in practice and decided to opt for the internship. Tilburg University organized an internship market. There were mainly employees of accounting firms; from small to (medium) large. I was curious about the industry and talked to people from different organizations, including Maartje (HR advisor) from Wesselman. She showed a lot of interest,” says Aniek. “That felt really good. A while later she called to inquire if I was interested in an internship. That’s how we finally got into a conversation.” Nice! What was it like getting acquainted with the organization this way? “Very nice. All interns are assigned a coach. The first period was sometimes exciting because Accountancy was new to me. BUT the guidance was very good and I could go to anyone with questions. In the end, they offered me a job as a working student or Assistant Accountant. A very good opportunity! The work-study position was more compatible with my schedule at the time. When I later decided to complete my studies part-time, I was still able to move up to Assistant Accountant. Basically, I assist the team, but of course I also take on tasks myself. If I need help, I can contact supervisors or other colleagues. I perform audits, but I also get to attend client meetings. It’s very interesting to get to know so many different companies.” Does it combine well with your studies? “In the first semester for sure! The contact hours for my studies were minimal. I had a subject in which I only had to go to school for once a week and wrote my thesis mainly in my own time. That was quite compatible! Currently, I have three more courses to complete. How the workload is going to be remains to be seen. Sometimes I have to finish some things in the evening for my studies, but that’s part of it. Despite that, I really enjoy being able to gain practical experience. It is very valuable that I get to make so many steps and learn new things,” Aniek says proudly. “I would recommend it to everyone to gain experience within the work field in this way! Next year I want to take a gap year. Time to think about the future.” What’s so great about working at Wesselman? “The click with Wesselman was there right away! It’s very cozy with colleagues; we regularly go out for drinks after work or play a game of padel together! Everyone is interested in each other and helps where necessary. That makes the atmosphere very pleasant.” Would you – like Aniek – like to work at Wesselman? Curious if you too have a click with Wesselman? We would like to discover it over a cup of coffee – or tea 😉 Interested? Then contact milou.kutscha@wesselman-info.nl.

Working at Zanders – Daan

Who are you and what do you do at Zanders? My name is Daan de Vries, I am 29 years old and live in Utrecht. I did a bachelor in Business Economics and a master in Finance, both at Tilburg University. During my master, I started working as an analyst at Zanders. This went so well that I started as a consultant in December 2019. Since then, I have advanced to a role as manager within the Treasury Advisory Group department. This department advises (listed) companies worldwide in the area of treasury. What is treasury? Treasury involves managing money and controlling financial risks in a company. Treasury’s priority is to ensure that the company can meet its daily business obligations. At the same time, your role as treasurer is to help develop long-term financial strategy and policies. Why did you choose Zanders? Zanders is an internationally oriented organization that focuses on complex treasury issues. These are often issues concerning both finance and technology. Therefore you’ll need to be interested in both areas and in my case it was exactly what I was looking for after completing my studies. I wanted to get an inside look at (international) companies in different industries and that is possible in this role. Although treasury is a niche area within finance, many study aspects are reflected in my work – such as financial risk management and debt financing. Zanders also has a flat organization structure where lines of communication are short and where you get a lot of freedom to develop yourself. In your first year as a consultant you participate in the Talent Program, which consists of three training weeks that take place throughout the year. During these weeks you will receive both professional and soft skill training from experienced colleagues and external trainers. The final week is at a location outside the Netherlands with other starting consultants from different departments and offices. Finally, at Zanders there is a good work-life balance, which is very important to me. Zanders also has a young team and fun activities are organized with and by colleagues. For example, once a year the Zanders Trip is organized; we then go with the whole company for an entire weekend to a destination in Europe that is secret until the last moment. There we then have all kinds of fun activities together. What do you deal with on a daily basis? This is a question that is often asked and is obviously very important. The answer depends on the projects I work on. I usually work on two projects at the same time. For each project, we have client meetings, provide reports and conduct workshops. In addition to the projects for clients, I also work on internal projects, which helps me develop myself in other areas of work. One of my internal projects is business development, where I have contact with existing and potential clients. For example, a day while conducting a strategic consulting project looks like this: 09:00-10:00 – Meeting with the client about actions regarding the Treasury Policy to be taken up today 10:00-12:00 – Edit the Treasury Policy and actions resulting from the meeting 12:00-13:00 – Lunch with colleagues, walk around 13:00-15:00 – Preparing a Treasury Policy workshop for next week 15:00-17:00 – Business development 17:00-20:00 – Friday drinks What advice would you give students? Most important is to know what interests you. Take your time to find out which companies match that. Go to recruitment days/events, in-house days and approach companies that seem interesting to you. You can visit us for an informal talk to see if Zanders and treasury suit you. Would you like to know more about Zanders and/or my experiences? Then send me a message via LinkedIn! https://zandersgroup.com/nl/ https://career.zanders.eu/

Jasper Vreman – Just Graduated

Who are you? I am Jasper Vreman, 23 years old and raised in Oud Gastel. In 2018 I started my bachelor’s degree in Business Economics in Tilburg, which I completed in 2021. Then I did both the master’s in Accountancy and Finance, also at Tilburg University. After completing both masters, I joined QVO Values, a start-up in corporate valuation, on September 1, 2023. What was graduation like? In 2021, I first started my master’s degree in Accountancy. I pretty much completed this master’s in the first year, except for one subject. In order to avoid paying a huge fee for the second master, you should not yet complete your first master. Therefore, I chose to leave one subject open. The master’s in Accountancy is special because you do not write a thesis, but an MSc File. Here, the thesis is divided into three parts, so to speak: the Business Application, the Replication Study and the Research Note. This divides the workload of one large thesis over an entire year. The Research Note is the largest “project,” and I wrote it under the supervision of KPMG in Rotterdam. I would recommend writing the Research Note with an employer to anyone to get a sense of your possible future work environment and what work is involved in the accountancy profession. All in all, I liked the setup of the MSc File, however, you now have a whole year of guilt if you prioritize social activities over an afternoon in the UB. The Finance master’s did require writing a full thesis. In January, I decided to apply for a research project within the thesis: here a group of thesis writers share the same direction, in my case inflation hedging, and that way you can help each other by sharing knowledge and tips. Also, you get a supervisor who is at home in this topic, which can help tremendously in thesis writing. With the help of my supervisor Rik Frehen, I experienced the whole thesis process as pleasant, with an 8 as the icing on the cake! What was the job search like? The serious job search started with a LinkedIn message, in which I mentioned that I had completed both masters and was looking for a job in Finance. I then sincerely received more than 100 responses from recruiters. Many messages were from secondment and interim finance firms, but of course many accounting firms sent messages as well. However, there was one message that stood out, from Henk Oosterhout. He stated that he was embarking on a new adventure: a start-up in corporate valuation. Now valuation was exactly what I was looking for: a lot of analytical thinking, but also a social touch through contact with clients. I then called Henk while I was still on vacation in South Africa. The first click was very good, and we decided to have a ‘formal’ job interview in Leiden, on the terrace. Here the initial suspicion was confirmed, and I subsequently started on September 1. What is it like working at QVO Values? Currently I have been working at QVO Values for more than four months and I am still enjoying it immensely. The great thing about a start-up is that you get to experience all aspects of the ins and outs of founding the company. For example, in the first month I got to give a valuation workshop for the tax and accounting reporting division of an AEX fund. Furthermore, giving guest lectures at the VU and RSM is of course unique. Because we would like to grow, we obviously need to hire more analysts. The nice thing about this is that Henk and I do the job interviews together. That way we can complement each other with questions for the applicant or information about QVO Values. What else do you do? Actually, apart from the start-up work, the work can be divided into three parts: modeling, deepening and appointments. Modeling very simply means developing models for valuation work. Because we are just starting out, we have to start completely from scratch. Although developing models may not sound very sexy, it does ensure that you get a better understanding of the models that you will then use in the future. In that way, I can say that I have learned an enormous amount in the past four months. Furthermore, delving deeper is mainly researching our customers and their competitors to get a better understanding of the customer, or an entire industry. Figures, of course, only tell part of the story: a low gross margin for a supermarket is not so crazy, but for a pharmaceutical company it is. Therefore, it is important to understand the company and its industry well. The last facet is agreements: the data supplied by our clients is sometimes incomplete or raises questions. To resolve the noise then, we have appointments to ask our questions. Furthermore, our results are checked by, for example, an audit firm or the tax authorities. If they then have questions, we also provide explanations in an appointment.

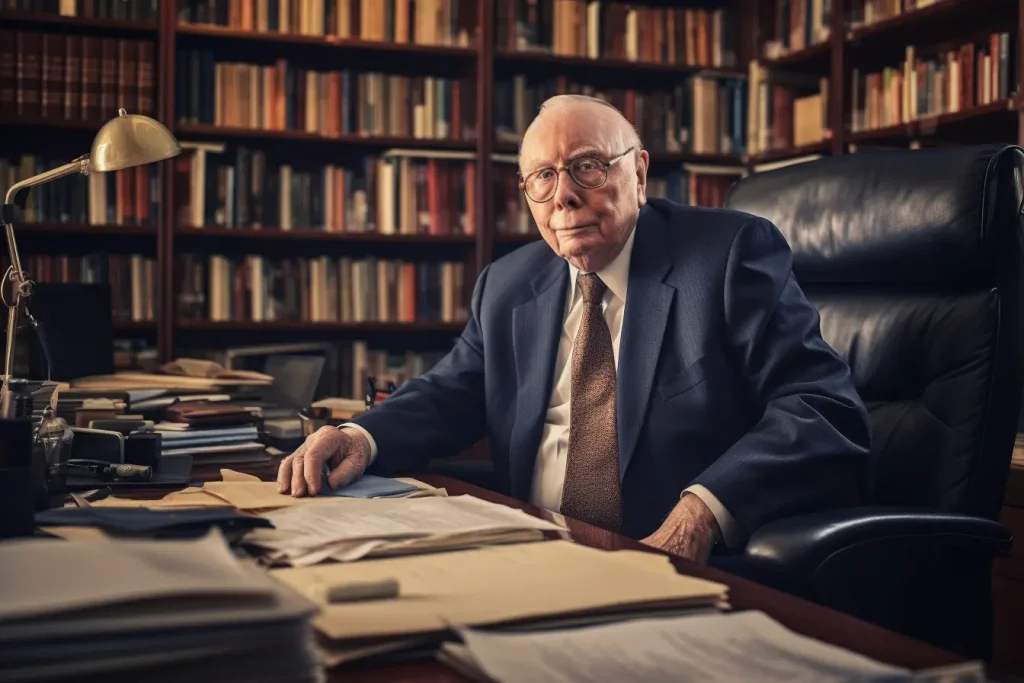

The story of Charlie Munger

In late November 2023, the life of iconic investor Charlie Munger sadly came to an end. Described by many as Warren Buffett’s confidant, however, he is much more than that. In this article, we look back on the successful life of this investor. Charlie Munger was born in Omaha, Nebraska, in 1924. He grew up during the Great Depression (1930s in the 20th century), which had a lasting impact on his outlook on both life and investing. In Omaha, the American also attended public school, where he soon managed to excel. He then went to the University of Michigan to study mathematics. This study he decided to interrupt to join the army during World War II. After his military service, he was admitted to Harvard Law School. During this study, he gained important knowledge, particularly in tax law, business law and contract law. Not soon after, he divorced his wife, to whom he lost all his money. Then his son died at the age of 8. Despite these setbacks, Mr Munger was determined to become successful. Soon fortune found him and he married his new wife. Because of the death of his father, he returned to Nebraska to take care for his family. Here he met his future business partner Warren Buffett. Next he moved to California to open his own law firm. He also opened his own investment firm called “Wheeler, Munger & Co” with his then business partner Jack Wheeler in 1962. From 1962 to 1975, his firm achieved an average return of 19.8%, while the Dow-Jones averaged “only” 5% per year in returns during this period. Nevertheless, the company made a loss during the oil crisis (1973), so Charlie Munger felt compelled to close the company. During this period, he also quit his law firm on the advice of Warren Buffett. Over the next few years, he began investing with, indeed, Warren Buffett before becoming vice chairman of Berkshire Hathaway in 1978. The golden duo was a reality. Investment philosophy Charlie Munger had a lot of influence on Warren Buffett’s investment strategy. For example, Warren Buffett used the so-called “cigar butt” method. This involved an investor buying an undervalued stock of a bad company. This with the idea of making a short-term profit. As a result, there came a change in Berkshire’s view regarding value investing: It stated: “Forget what you know about buying companies at nice prices, instead buy nice companies at fair prices.” Charlie Munger’s “mental models” also play an important role in his vision. He believed you needed a broad general knowledge to become successful as an investor. An investor needs knowledge in various subjects such as, indeed, law, but also in psychology, economics and mathematics. Charlie Munger was known as a man of great patience; this was reflected in his passive investment philosophy. He believed that making a profit was not a matter of buying or selling stocks, but rather patience and simply waiting. If you owned a stock long enough, its value would naturally move toward its intrinsic value. In addition, he was not an advocate of diversification. According to Munger, your returns are limited when you own many different stocks. Instead, he appointed that it is better to have a concentrated portfolio consisting of a limited number of stocks. When Charlie Munger died, he personally owned only 3 different stocks. Consequently, this mindset caused him to be selective. He believed that opportunities are always scarce and looks critically at new technologies. For example, he is absolutely not a fan of Bitcoin and even calls it the worst investment ever. This cautious view of new technologies is also a result of the fact that he thus grew up during the Great Depression. During his childhood, partly because of the Great Depression, there was a lot of poverty around him. As a result, he always remained cautious when it came to new technologies. Furthermore, Munger valued ethics within companies. Companies that do not act ethically will eventually make decisions that are bad for the company. Therefore, investors should stay away from companies that perform poorly in terms of ethics, even if they have potential financially. Charlie Munger himself was known as a reliable business partner, which no doubt was partly responsible for his successes. His view of ethics can also be seen in his philanthropic activities. For example, he donated at $300 million to make rooms more affordable for American students. Life Lessons Charlie Munger was known for his beautiful quotes and particular outlook on life. First, he emphasized the importance of lifelong learning. He mentioned that all the wise people around him read many books to keep gaining knowledge. Also, according to Munger, it is to look critically at your surroundings and surround yourself only with people who are trustworthy. Furthermore, Charlie Munger was a great advocate of personal growth, in this, he said, there was no room for self-pity, but rather discipline. Discipline, according to him, was necessary to become successful. Munger also believed that a person should be humble. Despite his status as a multibillionaire, he lived a relatively bleak existence and spent little money. This too was a result of growing up during the Great Depression. According to him, jealousy brings out the worst in man and should be avoided at all costs, for example by living frugally. All in all, we can conclude that Charlie Munger has been of great value to Berskhire Hathaway and the entire investment world. His wisdom will always be used.