After merger plans came off the table at the end of last year, AkzoNobel (Akzo) has not been in the news much. It seems the company is quite happy to maintain the status quo, after massive upheaval during 2017.

Most developments last year were of a negative nature. Shifts in the company’s management, the pressure from Akzo’s shareholders, a takeover threat from PPG, and the failure to takeover Axalta itself saw Akzo not improve its position, a view shared both by the media and investors.

Questions would have been raised in the minds of investors.

AkzoNobel Circling the Drain

Based on recent news, it would seem that Akzo is in a downward spiral. Last year, Elliott Capital, a major investor in the chemicals giant, reacted negatively when Akzo refused to seriously talk about a potential takeover bid from PPG. Elliott Capital even forced Akzo to appear at the Dutch Enterprise Chamber. The hedge fund raised even its stake to about 9% to have more influence on Akzo. Nevertheless, this increase in Elliot’s investment position did not help, as the hedge fund lost the court case against Akzo, and the takeover attempt was dismissed out of hand.

Elliott has since reversed direction by decreasing its investment position in Akzo by 4%, now holding only a 5% share of the company. Other major and loyal investment firms like Tweedy Brown, Columbia Threadneedle and Causeway also decreased their portfolio position. Was this as a consequence of Akzo’s decisions over the past year or was it just a coincidence?

It has not been all bad news for Akzo’s shareholders, though, as the company has also taken decisions that have benefited its investors. The firm has distributed a so-called super dividend, worth around €1bn. Furthermore, the company also sold its specialist chemical subsidiary to the Carlyle Group, a US private equity firm, and GIC, a Singapore-based investment firm. The potential gain from selling the chemical division is expected to be around €7.5bn. The majority of this will flow to shareholders by the end of the year as a combination of increased dividends and share buybacks. Regulatory approval is expected by the end of 2018.

Akzo has outlined some ambitious targets for 2018. The company wants to reach a profit margin of 15% by the year 2020, with a target of 10%-12% in 2018. Targeting small and middle-sized companies in takeovers will have a positive effect on reaching its profit margin targets. Still, a lot of investors ask the question of how the company is going to realise this growth? Thierry Vanlancke, CEO of Akzo, in March 2018 said:

“We want one integrated chain of suppliers, one business planning and one integrated manufacturing process.”

He believes that M&A practices, leading to an integrated company, will allow Akzo to reach their lofty targets. Akzo has approached Oliver Wight, a British advisory company, to support the company with its integration plans. Though this is a positive step, Mr Vanlancker, appointed at the end of 2017, still has a lot to do to win the trust of institutional investors. Many still question the feasibility of growing profit margin to of 10% for 2018 and 15% for 2020. Whether or not Akzo reaches its profit margins goals depends on the success of its M&A practices. In 2017, Akzo acquired Disa Technology, Flexcrete and Powdertech to further diversify its business portfolio. However, the company has so far failed to realise the necessary returns on these acquisitions. At the moment, it seems that investors are not confident in Akzo’s ability to fulfil its promises.

2018 Q1 Results

The first quarter of 2018 further confirms that Akzo is in a bad position. Revenues decreased by approximately 8% and the bottom-line results showed a decrease of 28%. This drop was partly due to falling sales in the marine and oil industries, as well as rising raw materials cost. In response to these high costs, the CEO stated:

“We are ramping up our pricing initiatives and have implemented various cost discipline measures to deal with higher raw-material prices.”

The company also experienced negative foreign currency effects, as foreign currencies decreased against the euro. This all added up to a decreased profit margin, from 8.8% to 6.8%. This is quite some from distance from the 2018 targets.

Impact on Share Price

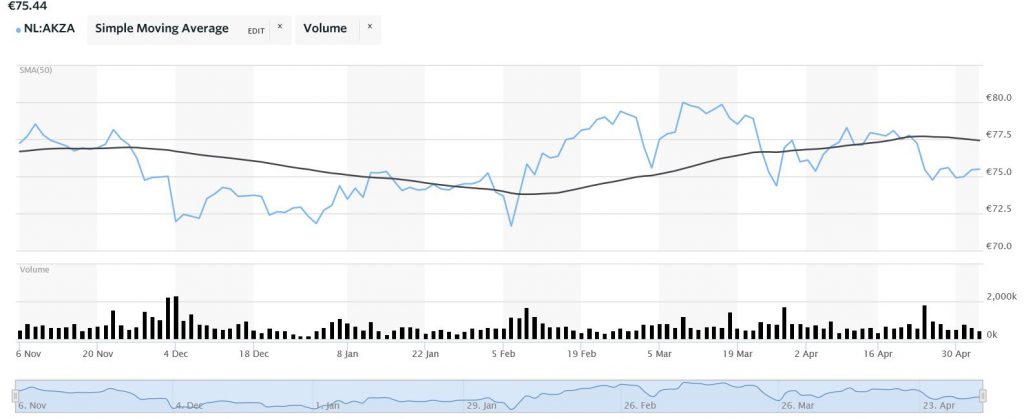

One would expect to see the bad results reflected in Akzo’s share price. The graph below shows Akzo’s share price development over the past months:

Source: MarketWatch

Before the Q1 results were announced on the 23rd of April, the price per share was €77.23. It decreased slightly in the immediate aftermath of the announcement to €74.25. However, Akzo’s share price experienced somewhat of a recovery and, at time of publication, has a value of €75.60. This is already an increase of over 1.50% from its post Q1 2018 announcement low. In short, it seems the doubts some have is already taken into account when valuing the company. Akzo’s share price has fluctuated between €70-€80 over the past year.

Conclusion

Akzo has been in a tough situation over the past years, with some investors raising concerns about its direction. After the underwhelming Q1 2018 results, the main question is whether or not Akzo is able to deliver on its targets? Although Mr Vanlancker mentioned that he expected headwinds during the first period of 2018, it will be interesting to see if these disappear as 2018 continues. These headwinds will have to reverse direction quickly, and support a rise of at least 3.2% in the profit margin in the company is to reach its goal. It has not been plain sailing for the chemicals company so far, but it may look to benefit from a change in the prevailing winds.